UPDATED Oct. 19, 8 p.m.: Anand Mahindra, the billionaire head of Indian conglomerate Mahindra Group, has teamed up with Rotem Rosen and a Deutsche Bank executive to launch a real estate company focused on Manhattan properties.

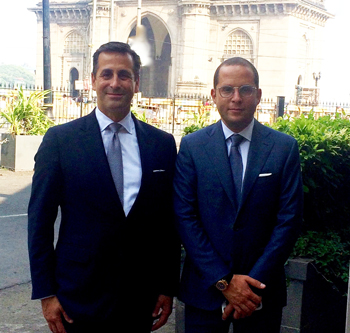

From left: Jerry Rotonda and Rotem Rosen

Called MRR Development, the firm plans to develop or reposition office, residential and hotel properties in Manhattan, targeting undervalued assets and holding over the long term, The Real Deal has learned. It wasn’t immediately clear how much the venture plans to spend on Manhattan real estate.

Representatives from MRR — headed by Mahindra, Rosen and Jerry Rotonda — could not immediately be reached for comment.

Mahindra Group is a $20 billion empire that includes verticals across manufacturing, information technology, and engineering, with operations in over 100 countries. The conglomerate has invested heavily in U.S. manufacturing, particularly in the Detroit area. “We invested $1 billion, we expected to double that over the next five years,” Mahindra told CNBC in July, referring to his investment in the U.S.

Earlier this year, Rosen sold his controlling interest in ASRR Capital, a publicly traded company he ran with Alex Sapir, for $70 million. Rosen is also partners with restaurateur Arjun Waney and billionaire Ferit Shenk. The three own Zuma restaurants in New York and Las Vegas and are bringing the Nusr-Et restaurant chain, headed by celebrity chef “Salt Bae,” to Manhattan.

Rotonda confirmed that he will step down as CFO for Deutsche Bank’s Americas wealth management branch, a position he’s held since 2011, but will remain as an advisor.