UPDATED: November 12, 2017

The day after President Trump and the House Republicans released their tax plan, Triplemint broker Collin Bond received the first call.

A client who’d just signed a contract on a $4 million home had one question: what does this all mean for her?

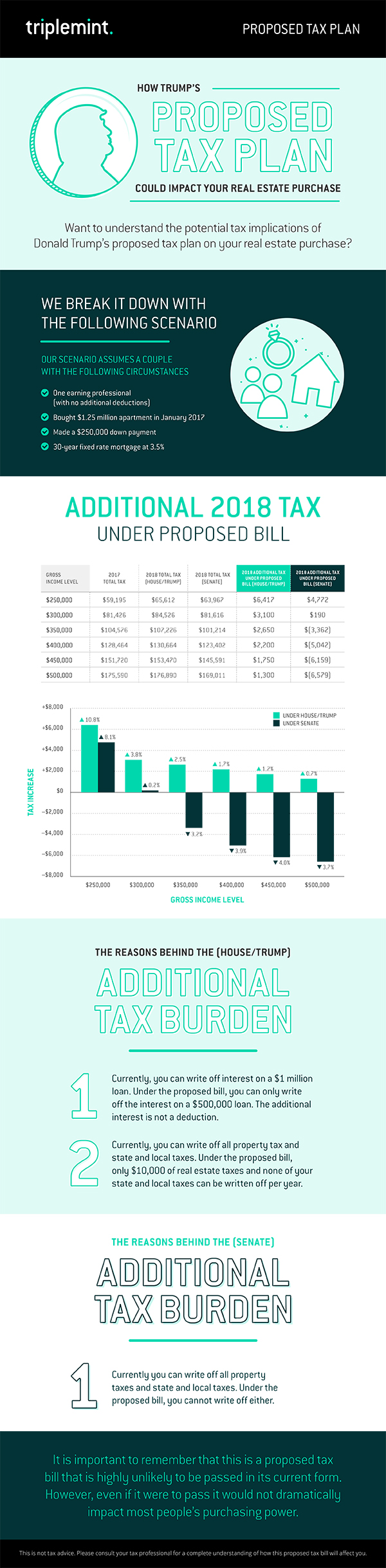

It was the first call of many for Bond, who joined Triplemint from Douglas Elliman six months ago, and prompted him to pull together an infographic illustrating how both the House and Senate tax plans would affect buyers with different incomes.

Bond’s infographic shows how households earning annual taxable incomes of between $250,000 up to $500,000 who bought a $1.25 million New York City apartment in January 2017 would fare under the current House and Senate plans, respectively. Bond’s scenario included a 30-year fixed-rate mortgage at 3.5 percent and $1,300 per month in real estate taxes.

“We wanted to put the important deductions that relate to home buyers in a vacuum,” said Nicholas Sher, a CPA who crunched the numbers for Triplemint.

They highlighted the $250,000 to $500,000 income brackets to reflect home buyers who rely the most on tax deductions from their purchases because, as Sher noted, “the couple that makes $1.5 million a year, while the mortgage interest helps them, it’s not a determinant in their decision.”

According to Bond and Sher’s calculations, a household with $250,000 annual taxable income — the minimum income you should be making “if you’re purchasing [a $1.25 million] apartment,” according to Bond — would bear the brunt of both plans with an additional $6,417 in taxes under the House plan, and $4,772 for the Senate’s. Higher incomes faced smaller tax increases.

Based on the analysis, the couple making $250,000 bears a “disproportionate” burden, Sher said. “We’re showing that the folks that make less get impacted more.”

Both Bond and Sher are quick to point out that their calculations only consider one part of the two proposed tax plans to the exclusion of other possible deductions individuals could file for, and only considers one aspect of a buyer’s financial circumstance — their gross annual income — without accounting for any investments or business ownership they may have.

“This is really a 30,000-foot view to give you an idea of where the pain points are,” said Bond.

That disclaimer aside, Bond and Sher each had different takeaways from the data.

Bond sees coastal areas, like Westchester, known for high taxes and quality schools, taking a hit if homeowners aren’t able to take mortgage and/or state-local income tax deductions they were planning for.

Meanwhile, Sher is considering how to adjust his advice to clients so they can take advantage of remaining loopholes or change their financial planning strategy. “I prefer to call them matters of legislative grace,” he said.

Story updated to include the apartment’s assumed monthly taxes.

See Bond’s infographic below:

(Courtesy of Triplemint)