Trending

Foreclosures in NYC hit highest level since 2009: report

City saw 58% year-over-year increase

It’s not yet clear if the GOP tax overhaul will drive up foreclosures — as some have predicted — but New York City is already seeing a high volume of homes hit the auction block.

Foreclosures reached 3,306 citywide in 2017, marking the highest volume seen since 2009, according to a new analysis by real estate data company PropertyShark. In the aftermath of the financial crisis, the number of homes scheduled for auction hit 3,360.

Last year’s foreclosure tally represents a 58 percent year-over-year increase and the third-highest number in the last decade — only falling behind the grim years of 2008 and 2009. PropertyShark notes that the number of cases has nearly doubled in two years, since 2015 only logged 1,762 new foreclosure auctions.

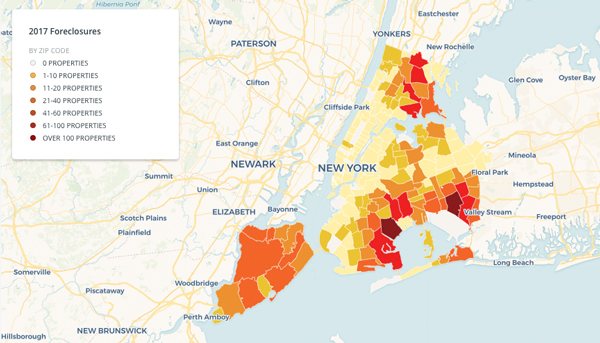

Staten Island saw the largest increase of all the boroughs — a 134 percent year-over-year jump — with 428 first-time auctions scheduled in 2017. Brooklyn followed with a 50 percent spike. Canarsie and East New York were among the neighborhoods hit the hardest, according to PropertyShark.

Queens and the Bronx saw a respective 40 and 44 percent increase, while the number of foreclosures in Manhattan remained flat. (Though it should be noted that what is presumed to be the largest foreclosure in city history occurred in Manhattan last year. A full-floor penthouse at Extell Development’s One57 sold for $36 million in November, down from the $50.9 million the previous owner paid.)

Queens saw the most scheduled auctions in 2017 with 1,260.

The uptick in foreclosures follows a dramatic dip between 2011 and 2012, when the number of foreclosure fell from 2,988 to 936. Foreclosures have gradually increased in the city since then.

It’s unclear if the city will continue on this upward trajectory, though there are some headwinds. In speaking out against the new tax law, Gov. Andrew Cuomo has said that home values could drop and mortgage foreclosures may spike.