The city’s investment sales market had another down year in 2017, though some promising signs at the tail end could bode well for 2018.

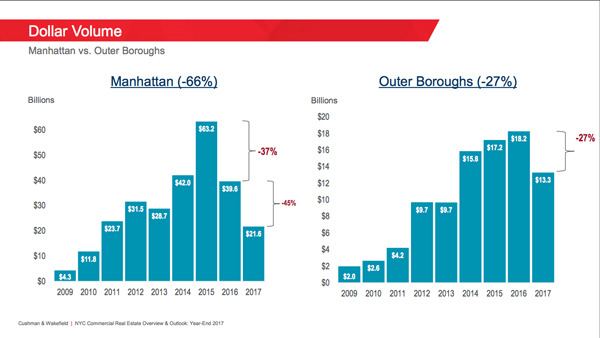

Investors spent a total of $34.9 billion on commercial property last year, down nearly 40 percent from 2016, according to Cushman & Wakefield. It marked the second straight year in which dollar volumes fell, as 2017’s totals were off nearly 57 percent from the peak this cycle of $80.4 billion in 2015.

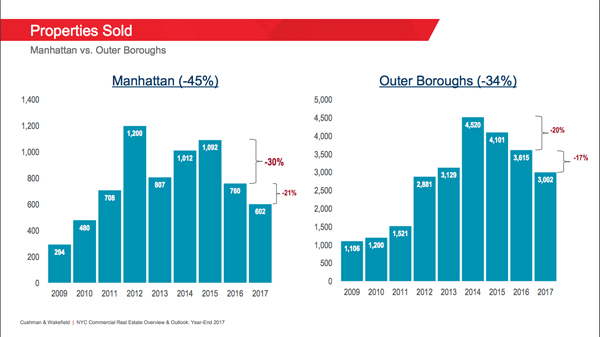

In Manhattan, the number of properties sold fell 21 percent year-over-year to 602, and the total dollar volume of deals was off 45 percent to $21.6 billion. But it could have been worse. Cushman’s Douglas Harmon said during the company’s year-end conference call Wednesday morning that when the number-crunchers looked at the figures six months ago, “it was a very dire prediction for 2017.”

At the halfway point of 2017, Manhattan was trending toward a decline of 55 to 60 percent in sales volumes, so in that context the 45 percent drop was a bit of a silver lining.

“The good news is that in the second half there ended up being a lot of transactions,” he said. “As I sit today forecasting what it looks like for ’18, it’s much more upbeat.”

In the outer boroughs, the number of properties sold declined by 17 percent to 3,002, and the dollar volume fell 27 percent to $13.3 billion, according to Cushman.

When it came to property values, though, Manhattan and the outer boroughs were heading in different directions.

The average price per square foot across all Manhattan property types (excluding retail) turned negative during the third quarter. The average price per square foot for 2017 was down 4 percent compared to 2016 at $1,386.

“That’s the first time that’s happened in this cycle, and this is not surprising,” Cushman’s Bob Knakal said. “Because when we have a correcting market the volume of sales will always fall before value falls.”

In the outer boroughs, however, pricing continued to climb. The average price per square foot was up 7 percent in 2017 year-over-year to $406 on properties sold (again, exclusive of retail), though Knakal said he expects that trend to turn “as contagion from what has happened in Manhattan leaks into the outer boroughs.”

But there are some positive signs for 2018. Knakal noted that previous market corrections had been precipitated by events that sparked broader economic recessions: the savings and loan crisis that saw a decline in real estate deal volumes for four years from 1989-1993, the burst of the dot-com bubble that kicked off a four-year market downturn from 2001 to 2004 and the Great Recession that chilled the market from 2007 to 2010.

This time around, though, there was no catalytic event that shocked the market into a slowdown. And recent events like tax reform could be a boon in 2018. The investment-sales broker also pointed out that while closings were “abysmal” last year, contract execution was up “very, very significantly.”

“It was reminiscent of a couple of years ago,” he said. “That will manifest itself in better activity in the first half of 2018 and we’re looking forward to that increase.”