UPDATED: January 28, 2018 with hotel operator name.

Replay Resorts is developing a 132-acre five-star luxury resort in Half Moon Bay, Antigua, which includes property formerly owned by the late Rachel “Bunny” Mellon, an heiress and famed taste-maker known for her influence on Jackie Kennedy Onassis.

Speaking on behalf of the Canadian developer, William Anderson, who is the CEO of the project, said the company bought the land in two transactions — the total price of which he would not disclose. The first transaction, he explained, was Replay’s 2015 purchase from the government of a lot with a defunct hotel that had been damaged after a 1995 hurricane and never repaired.

The second, made in 2016, was of the undeveloped 30-acre plot formerly owned by Mellon, who had preserved the untouched property as a means of maintaining pristine views from her long-time house at the Mill Reef Club which faced the rocky peninsula, according to Anderson. The 2016 sale occurred after Mellon’s death in 2014.

“We could have done the resort without the Mellon land,” said Anderson, “but we chose to purchase [it] from the estate…because in some ways it really was the most dramatic feature.”

(Credit: Half Moon Bay Antigua)

(Credit: Half Moon Bay Antigua)

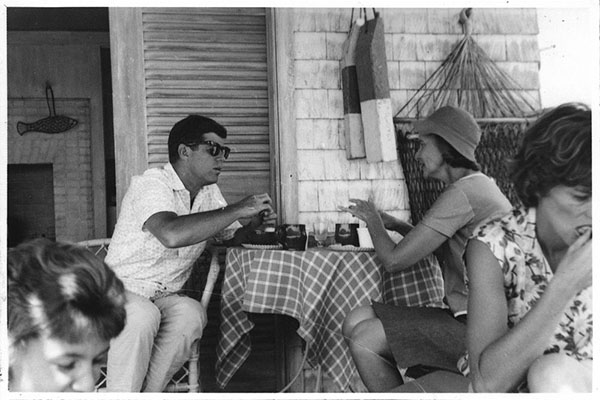

Back left to right, John F. Kennedy and Bunny Mellon. Undated between 1961-1962. (Credit: Mark Shaw, courtesy Jacqueline Bouvier Kennedy Onassis Personal Papers. John F. Kennedy Presidential Library and Museum, Boston)

Anderson said Replay is the primary investor in the project, though additional financing came from two external partners and a portion was raised through Antigua’s Citizenship by Investment program — for approved real estate projects the minimum investment is $400,000.

Since purchasing the land, Replay has been working on a master plan for the new resort, which will include 1,500-square-foot guest villas, complete with their own pools and terraces, and 40 to 50 branded villas, clustered in quads, which will be for sale. The resort will be operated by Rosewood Hotels & Resorts.

The crown jewels of the resort, however, are the 13 lots where buyers can develop their own estates on property ranging from 2-acre beachfront lots, which are selling for $10 million, to a less than 1-acre cliff-side lot, going for between $3.5 million to $7 million.

The former Mellon-owned peninsula will hold two of these custom lots, the largest of which is on sale for $25 million, the smaller lot is for $10 million. According to the New York Post, the properties are already being sized up by “high-profile tech titans.”

Anderson said Replay is targeting buyers in New York and London, and has teamed up with Bespoke in NYC. The resort is estimated to be completed by 2021.