Longwood and Morrisania may not have completely escaped the problems that plagued the South Bronx during the infamous 1970s, but there are growing signs that the two adjacent neighborhoods are ready for their time in the spotlight.

A brownstone-lined street in Longwood’s historic district

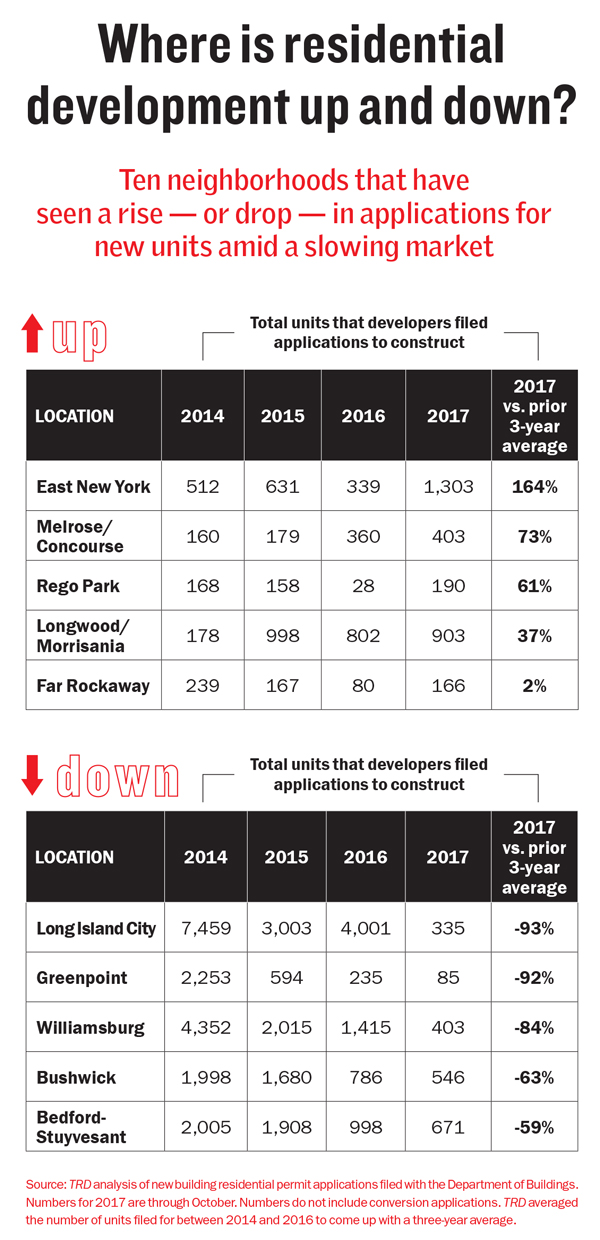

The number of proposed residential units in Longwood and Morrisania skyrocketed 1,137 percent from 73 in 2008 to 903 units last year, according to TRD’s analysis of DOB data. Commercial sales volume has more than doubled, jumping to $152 million from about $64 million over the same time period.

Haniff Baksh, principal broker at the Bronx’s Besmatch Realty, said there has been a particularly strong uptick in renovations to the neighborhoods’ older housing stock.

“What we’re seeing is a lot of these older properties, they are being sold,” he said, “[and] either rehabbed, or in some cases there are some new developments in the area.”

The current housing stock in Longwood and Morrisania is a mixture of properties ranging from smaller one-family homes to public housing to apartment buildings with roughly 40 to 50 units, Baksh said. But some developers have filed plans for much larger projects in the neighborhoods.

The Ader Group, a real estate investment firm based upstate, is planning a 14-story, 243-unit affordable building on the site of a former parking facility — the first phase of a two-building, 474-unit complex. Additionally, Manhattan-based Property Resources Corporation filed plans for an eight-story, mixed-income building alongside two five-story buildings at 970 Kelly Street, a development that will contain 161 residential units. And on the border of Morrisania and Melrose, BFC Partners and WHEDco are planning the massive Bronx Commons project, which will include 305 affordable housing units and a 300-seat music hall.

Land prices in the area are generally between $50 and $60 per buildable square foot, according to Michael Tortorici, executive vice president at Ariel Property Advisors. He said that returns are currently easier to come by with affordable developments, but market-rate projects will likely become more prevalent.

“The difference between market-rate and affordable in the Bronx is not as wide as in other areas of the city,” he said. “So when subsidies are available to do affordable, sometimes it tips the scale to do it that way.”

Liang Li, a real estate agent with Nest Seekers International who lives and works in Longwood, said he’s lately been seeing more interest in the neighborhood from Harlem residents who are looking to get more space for less money.

“Not just the rent part,” he said. “It’s also cost of living. Just by comparing the cost of coffee or orange juice, I think that also matters for some people.”

Median asking rents in Longwood were $1,825 and $1,900 in Morrisania as of November, according to StreetEasy. That was significantly cheaper than East, Central and West Harlem, where they were $2,300, $2,397 and $2,725, respectively.

Median asking rents in Longwood were $1,825 and $1,900 in Morrisania as of November, according to StreetEasy. That was significantly cheaper than East, Central and West Harlem, where they were $2,300, $2,397 and $2,725, respectively.

However, Longwood and Morrisania still lack some of the hallmarks of gentrifying areas. For instance, there has yet to be a burst of trendy new restaurants and cafes. Retail in the neighborhood, concentrated on Boston Road and Third Avenue, is largely a mix of discount stores, hair salons, delis and other small businesses.

Morrisania is part of the poorest neighborhood district in NYC, according to city statistics from 2015, while in Longwood, almost 50 percent of households are considered “rent-burdened.” However, crime has been steadily dropping. Over the past seven years, murders in the precincts covering Longwood and Morrisania have dropped 50 percent and 20 percent, respectively, according to stats from the NYPD.

Tortorici said investors based in Manhattan are eager to snatch up multifamily properties throughout the Bronx, and Longwood and Morrisania are no exception to this.

“I think Manhattan investors are looking at any multifamily that they can see in the Bronx. I don’t think it’s exclusive to necessarily a neighborhood,” he said. “If it’s in Longwood or Morrisania, they’re paying attention to those offerings.”

Click here to read more about outer borough areas that investors are running to in New York City.