Rockpoint Group doesn’t have the Blackstone Group’s size or CIM Group’s flashy development portfolio. But the Boston-based firm still managed to quietly emerge as the most active private equity real estate investor in New York over the past year.

Rockpoint and its partners signed contracts to buy $1.73 billion worth of properties in the Greater New York area over the past 12 months, according to Real Capital Analytics. Only China’s HNA Group, which shelled out $2.21 billion for 245 Park Avenue, committed more money.

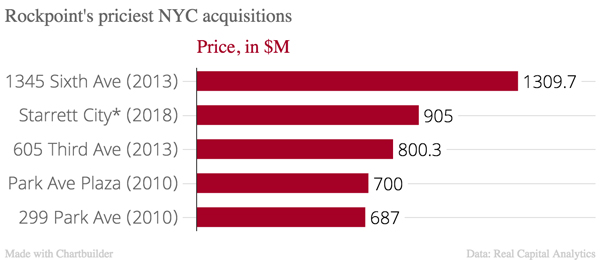

On Tuesday, news broke that Rockpoint bought the Midtown office tower 1700 Broadway from Ruben Companies for $465 million. But the firm’s biggest deal of the year, the $905 million acquisition of Starrett City with Brooksville Company, is still in limbo, pending state and federal approval.

Brokers who have worked with Rockpoint say the firm has a good eye for deals and is easy to work with — a key advantage when it comes to winning over potential joint venture partners. “They have a well-earned reputation for being user-friendly and gentlemanly,” said Hodges Ward Elliott’s Will Silverman.

Cushman & Wakefield’s Doug Harmon, who brokered the 1700 Broadway sale, touted the firm’s flexibility, taking on anything from trophy tower acquisitions to affordable housing deals to new development. “They can do complicated deals of almost any size and scope” despite being run by a relatively small team, he said. The firm’s top executives, he said, “are new Englanders that just happen to ‘double’ as New Yorkers.”

Rockpoint was founded in 2003, when five managing members of investment firm Westbrook Real Estate Partners — Bill Walton, Greg Hartman, Jonathan Paul, Keith Gelb and Pat Fox — left to launch their own business.

Only Walton and Gelb are still with Rockpoint, according to its website. They continued to control Westbrook until it sold its last assets in 2014. The now-defunct business has no connection to Westbrook Partners, another real estate investment company that’s currently active in New York.

Paisley Boney, a Wachovia Securities alum, is usually Rockpoint’s pair of boots on the ground in New York, Silverman said.

Rockpoint made its first Manhattan acquisition in January 2005, paying $215 million for the Park Central Hotel at 870 Seventh Avenue in partnership with Highgate and Whitehall Real Estate Funds. Over the following years, the fund manager developed a knack for flipping properties at a sky-high prices. And it often works with the same partners.

For example, Rockpoint paid about $340 million for a 49 percent stake in Fisher Brothers’ office tower 299 Park Avenue in January 2010 and sold it for $569 million in August 2011. In December 2013, Rockpoint took a 49 percent stake in Fisher Brothers’ 1345 Sixth Avenue and 605 Third Avenue, which valued the buildings at $1.31 billion, according to RCA data. A year later Rockpoint sold its stake in both buildings to an unknown buyer in a deal that valued the properties at $2.5 billion.

Rockpoint has been especially active in New York City of late. In the last 18 months, the firm has sold its 25 percent stake in One Soho Square to Stellar Management in a deal that valued the building at $650 million; bought a pair of rental buildings on Wall Street for about $300 million; and paid $300 million for a stake in Roseland Residential Trust, a subsidiary of New Jersey-based developer Mack-Cali. Rockpoint is one of the developers behind 413 West 14th Street, a pricey boutique office project in the Meatpacking District. It also retains a stake in the ongoing Williamsburg condominium conversion project at 184 Kent Avenue, where it’s partnering with Kushner Companies and LIVWRK.

Rockpoint’s successful investments helped it raise larger and larger funds. Rockpoint Real Estate Fund I, launched in 2004, won $904 million in investor commitments. Its newest closed-end vehicle, Rockpoint Real Estate Fund V, closed at $3.3 billion in 2016. The company also runs open-ended, lower yield funds similar to Blackstone’s core-plus vehicles.

Rockpoint owns stakes in 178 buildings across the U.S., Germany, Great Britain and Japan, according to RCA. Those buildings are collectively valued at $18 billion, according to RCA data.

It hasn’t always been smooth sailing for the quiet giant. Take Starrett City. When Rockpoint and Andrew MacArthur’s Brooksville agreed to buy the federally subsidized housing complex in Brooklyn last year, President Trump’s 4 percent stake in the seller created plenty of controversy. He reportedly stands to personally pocket $14 million from a deal the federal government has to approve.

And in September, a group of Starrett City minority owners including the late Disque Deane’s children sued their stepmother Carol Deane’s company, seeking to block a sale she greenlighted. Earlier this month a judge tossed the suit, removing the last major obstacle blocking the sale and Rockpoint’s ascent to the top of Manhattan’s private equity real estate pecking order.