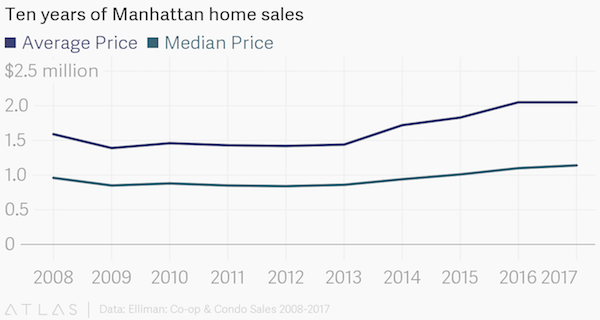

What a difference 10 years makes. Home prices in Manhattan were lethargic in 2017 when compared with the previous year, but downright feisty if you look a little farther back.

Today, the average price of Manhattan condos and co-ops stands at $2 million, which is flat compared to 2016, but up 29 percent from 2008 — the peak year before the financial crisis and recession — and up 47 percent from the low point of $1.4 million in 2010, according to a market report from Douglas Elliman.

Looking back over the last decade, the data shows prices dropping sharply after 2008, hitting a low in 2010, and then rebounding thanks to the new development boom beginning in roughly 2012.

“Around 2012 was the beginning of the new development cycle,” said Jonathan Miller, CEO at appraisal firm Miller Samuel and author of the report. “Then we had five years of rapid growth, related to more expensive housing stock entering the mix.”

The number of sales followed a similar trajectory. Sales dropped off a cliff in 2009 with just 7,430 purchases, then peaked in 2014 with 12,695 sales. In 2017, the market posted a respectable 11,927 sales, a 4 percent increase from the previous year.

Manhattan co-op and condo sales from 2008 to 2017. (Chart courtesy of Douglas Elliman)

When breaking down the sales growth by unit type, it becomes clear that apartment with three bedrooms or more led the charge, pointing to the influx of new development units. Those apartment sales more than tripled over the last decade, from 606 in 2008 to 2,128 in 2017. By contrast, sales of studios and two bedrooms decreased from a decade ago.

While prices are back, the money won’t go as far as it did in 2008, reflected by the fact that price-per-square-foot shot up faster than overall pricing, coming in at $1,775 a square foot in 2017. Again, there’s no change from last year, but that’s a 42 percent change from 2008, and a 67 percent change from the low point of $1,060 per square foot in 2010.

For townhouses, the numbers tell a slightly different story, with fewer sales going at higher prices. Townhouses sold for an average of $6.7 million in 2017, up 5 percent from the previous year, but down 11 percent from 2008. There were 250 townhouse sales in 2017, down 18 percent from last year’s 306, while inventory declined as well to 354 from 411.