Trending

Office deals in Brooklyn rise, while multifamily sees fewer property trades

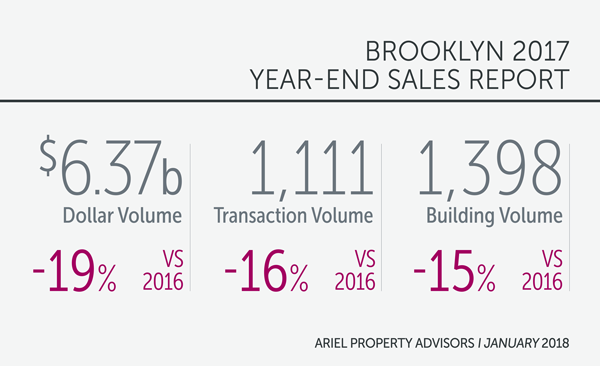

Total investment sales in the borough dropped 19 percent in 2017

While multifamily and land sales in Brooklyn fell last year, office investment quintupled.

Office deals in the borough totaled $757 million in 2017, up 553 percent from 2016, according to a recent report from Ariel Property Advisors. The two deals that drove that volume were CIM Group’s $171 million buy of SL Green Realty’s 16 Court Square, and RFR Realty and Kushner Companies’ $408 million acquisition of a stake in the Dumbo Heights office portfolio.

On the whole, the office sector — which accounted for 12 percent of Brooklyn investment dollars — was not enough to tip the scales for the borough. The dollar volume of deals was down 19 percent from the previous year, totaling $6.37 billion. With 1,111 deals, the average trade was $5.7 million, down from $5.9 million in 2016.

Meanwhile, multifamily sales amounted to $2.72 billion, a 35 percent decline from the previous year and 40 percent dip from 2015. Dollar volume for development and industrial sites fell 30 percent to $2.18 billion.

Pricing for those two asset classes also slipped for the first time since 2012. Land prices decreased to $248 per buildable square foot from $262, a return to 2015 levels, and price per multifamily unit slipped to $316,000 from $326,000. However, the price per square foot in multifamily deals rose to $388 from $376.

On the positive, special purpose deals saw gains thanks to increased investment from the medical and education sectors. And two areas of uncertainty for investors were resolved in 2017: the reinstatement of the 421a subsidy and tax reform, which could be a boon for commercial real estate buyers.