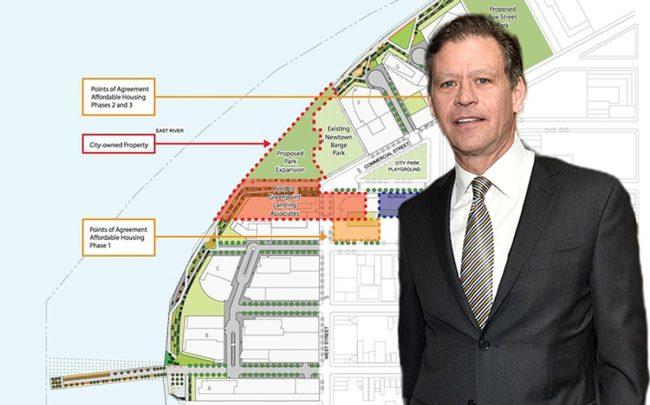

Ric Clark and the Greenpoint Landing Plan (Credit: Getty Images and Greenpoint Waterfront Association for Parks and Planning)

UPDATED: Tues., June 5 @ 3:00 p.m.: Brookfield Property Partners bought into two Park Tower Group development sites at Greenpoint Landing, records filed with the city Tuesday show. With Park Tower Group, the joint venture stake in the two sites, one on Commercial Street and the other on West and Eagle Streets, is valued at $148 million.

The sites are the very same where Brookfield announced late last month it would build two new rental projects, in partnership with Park Tower Group. The new buildings, Brookfield said, would hold a total of 1,240 units. Brookfield previously developed two other rentals at Greenpoint Landing with Park Tower Group, including the 373-unit 37 Commercial Street (also known as 37 Blue Slip).

The partners are financing the deal with an $89 million loan from Industrial and Commercial Bank of China, records show.

A spokesperson for Park Tower declined to specify how much ownership Park Tower would retain in the new partnership.

Park Tower is the master developer of Greenpoint Landing, which encompasses 22 acres on the most northern edge of the north Brooklyn neighborhood and is slated to bring 5,500 units of mostly market-rate housing. 1,400 affordable units are also under development in partnership with L+M Development Partners and 300 of those have already opened.

Brookfield, which is headquartered in Toronto, has always been one of the most prominent investors in the New York real estate market. But over the past six months, it’s made some really big development plays, including the purchase of what is slated to be the Bronx’s biggest private development from the Chetrit Group and Somerset Partners.

Correction: This story was updated to reflect that Park Tower Group is retaining ownership in the two development sites mentioned.