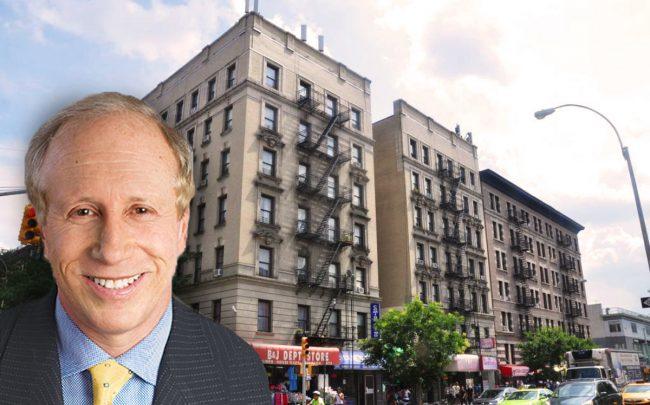

Larry Gluck’s Stellar Management is purchasing another rental building in Hamilton Heights for $26.5 million, sources told The Real Deal.

Stellar is in contract to acquire the building at 3430 Broadway, near West 140th Street. The property contains 57 apartments, along with 5,500 square feet of retail, according to property records. The six-story building spans 73,000 square feet overall, putting the purchase price at about $364 per square foot and about $465,000 per door.

The owner is listed in records as Woodcrest Management Corporation, run by Steven Schneider. The company could not be reached for comment, and Stellar declined to comment on the deal.

Stellar, one of the largest residential landlords in New York, purchased another building in Hamilton Heights about three blocks north at 3501-3509 Broadway for $26 million in February.

The company also bought the leasehold for the Flatiron District office building at 218-220 Fifth Avenue with Imperium Capital last year.