Trending

Chetrit Group out at 9 Dekalb Avenue, Brooklyn’s tallest development

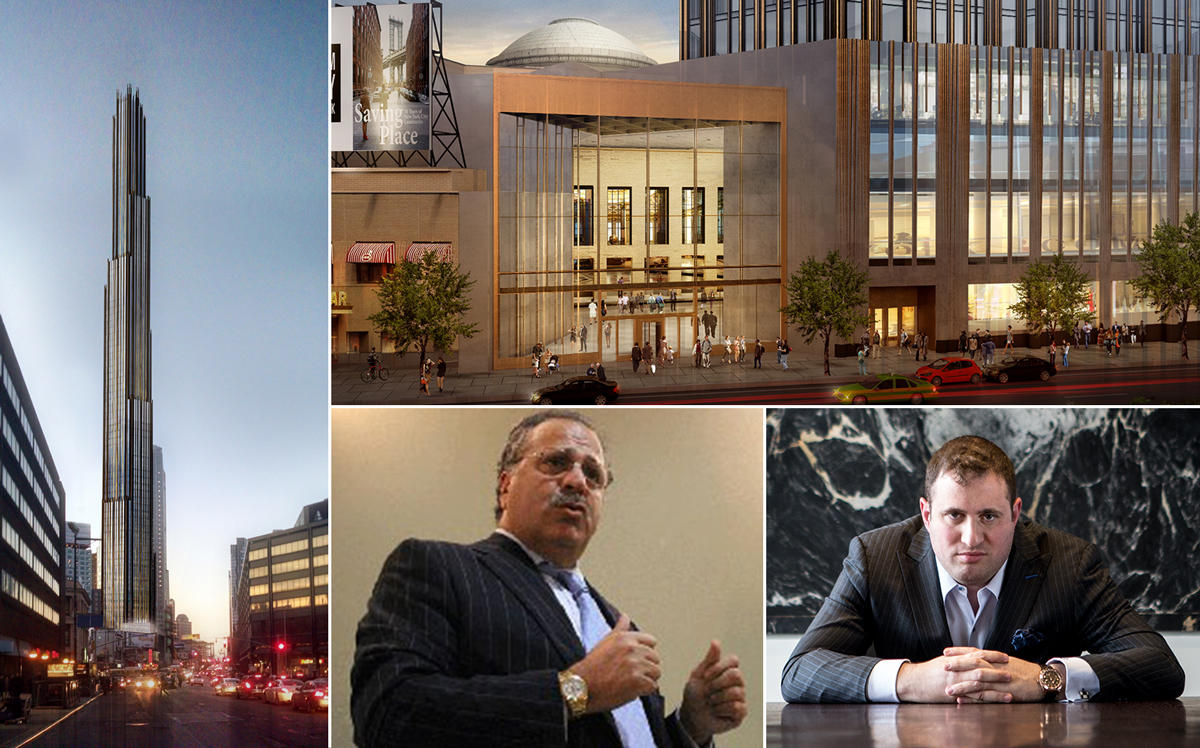

Michael Stern’s JDS is taking full ownership of the 1,066-foot tall development

Michael Stern’s JDS Development Group is taking full ownership of the supertall development at 9 Dekalb Avenue in Downtown Brooklyn.

The developer bought out partner Chetrit Group for nearly $60 million, sources told The Real Deal.

Chetrit acted on a “put option” in the ownership agreement, which allowed the firm to sell its stake, according to sources. JDS declined to comment, and a representative for Chetrit did not immediately respond to a request for comment.

The developers had secured a $135 million pre-development financing package from Bank of the Ozarks and Melody Finance in 2017 for what is set to be a Brooklyn’s tallest tower at 1,066 feet. At the time that debt deal closed, the developers were said to be on the hunt for a $265 million construction loan to complete the 73-story, mixed-use project.

Stern and Joseph Chetrit lined up the first piece of the assemblage in 2014, paying $43.5 million for an office building at 340-366 Flatbush Avenue Extension. The property had 174,000 square feet of development rights, and the developers tacked on an additional 300,000 the following year with the purchase of the adjacent former Dime Savings Bank for $90 million.

SHoP Architects is designing 9 Dekalb, which will span 556,000 square feet — 93,000 of which will be commercial. The old bank building, which was landmarked in 1994, will hold retail. The project will contain a mix of rentals and condominiums.

Nearby, Gary Barnett’s Extell Development is building a 68-story residential tower dubbed Brooklyn Point. The developer finalized a $530 million financing package for the project’s construction late last month.

Barnett is aiming for a sellout of $901 million, which would set a record for Brooklyn.