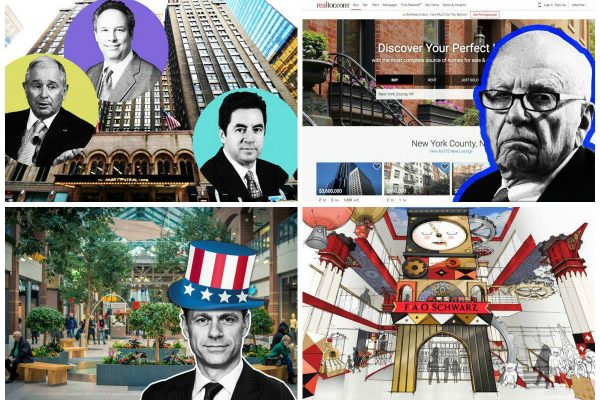

Brookfield’s $23B in deals this year makes it the top dealmaker in North America

Brookfield Asset Management has a higher total value of real estate transactions this year than Blackstone Group, making it the top real estate dealmaker in North America, Bloomberg reported. Brookfield logged $23 billion worth of transactions this year — aided in large part by its acquisition of a 66 percent stake in mall owner General Growth Properties, which cost the company $15 billion. Brookfield Property Partners chief executive Brian Kingston said the company “look[s] for places where people are running away from.” “Ultimately we’re value investors. So that means many times it leads you to being contrarian,” he said. Brookfield has also snapped up Forest City Realty Trust and taken a 99-year-lease on 666 Fifth Avenue from owner Kushner Companies. [TRD]

News Corp. subsidiary shells out $210M for lead generation startup

Move Inc., a company within Rupert Murdoch’s News Corp, is snapping up another real estate-centric business. The subsidiary, which already operates Realtor.com, will shell out $210 million for Opcity, an Austin-based lead generation startup that uses an algorithm to match agents and mortgage brokers with pre-screened buyers. Opcity said around 40,000 agents from firms including ReMax and Century 21 use its services. The purchase is part of News Corp’s plan to take advantage of the “burgeoning digital real estate services market,” News Corp CEO Robert Thomson said in a statement. [TRD]

Starter home prices are higher than they’ve been since 2008

The cost of buying a starter home is higher than it’s been since 2008, Bloomberg first reported. Prospective homeowners needed to spend nearly 23 percent of their income to afford a standard starter home in the second quarter of 2018, up from 21 percent in the same quarter last year. Tighter inventory has driven up prices, and in places like New York and San Francisco, the median household has to shell out around 65 percent of its income for a home. “When prices go up at the entry level, that’s where the affordability issue is most acute,” Wells Fargo economist Charles Dougherty told the outlet. “People are hesitant to stretch the amount they’re willing to pay.” [TRD]

LaSalle Hotel Properties taking another look at Pebblebrook as Blackstone declines to increase its $3.7B offer

In June, LaSalle Hotel Properties accepted Blackstone Group’s bid for the company and rejected Pebblebrook Hotel Trust’s advances. Now, however, LaSalle may be reconsidering, as Pebblebrook may have made a superior offer, Bloomberg reported. Blackstone isn’t planning to up its $3.7 billion offer for LaSalle, so it’s possible LaSalle could end up accepting an offer from Pebblebrook, which would leave Blackstone with a $112 million severance fee. LaSalle, however, said there could “be no assurance that the discussions with Pebblebrook will result in the board’s determination that the Pebblebrook proposal is a superior proposal or the consummation of a transaction that is superior to the pending transaction with Blackstone.” [TRD]

MAJOR MARKET HIGHLIGHTS

FAO Schwarz will return to Manhattan in November with a new flagship store

FAO Schwarz is returning to Manhattan, the Wall Street Journal reported. The toy store, which closed in 2015, will open a new flagship shop at Rockefeller Center in November. Its new owner, ThreeSixty Brands, is leasing the 20,000-square-foot space from Tishman Speyer, though it’s not clear for how much. A retail expert told the outlet that the reopening “feels like an advertising play,” as it’s possible ThreeSixty won’t end up making a profit on the store. ThreeSixty is also planning to open FAO Schwarz stores in China and at LaGuardia Airport. [TRD]

Developer plans to build giant sports and entertainment complex in Chicago suburb

A Chicago suburb will be getting a giant sports and entertainment complex, the Daily Herald reported. Glenstar Properties secured approval for the Lincolnshire project: a 450,000-square-foot facility called The St. James that will sit on 43 acres. The complex will house a FIFA soccer regulation field house, a water park, two ice hockey rinks, an Olympic-sized pool, a fitness center and an “active entertainment center,” according to the outlet. GlenStar wanted to open a Topgolf driving range in the complex, but officials did not greenlight that plan. [TRD]

Firm envisions vacant LA shopping mall space becoming transitional housing

An Irvine-based architecture and design firm hopes to address homelessness by turning unused big box stores into mixed-use spaces for transitional housing and social services. KTGY Architecture + Planning’s concept, called Re-Habit, would address both the rise in homelessness in the country and the rise in vacant retail space, Re Journals reported. Los Angeles is one of the cities dealing with homelessness and an affordable housing crisis that could benefit from the concept. The concept is still in its early phases, KTGY noted. [TRD]

Washington D.C. real estate market is ‘considerably’ slower this year than last year

There’s more than one brand of deadlock happening in Washington D.C.: its real estate market is “considerably” slow this year when compared against last year, the Washington Post reported. Last July, homes in the metro area typically stayed on the market for 19 days. This year, that number stands at 39 days. Only 21 percent of homes that sold in July, meanwhile, sold in two weeks or less, compared to 43 percent last year. The slowdown may be due to an increased inventory in the city, with “buyers… feeling less frenzied and taking a bit more time in their home search,” the outlet reported. [WaPo]