Outer-borough hotel construction has been on a roll lately, with new construction in light manufacturing zones being a major driver. That window may be closing soon, but hotel builders seem determined to go out with a bang.

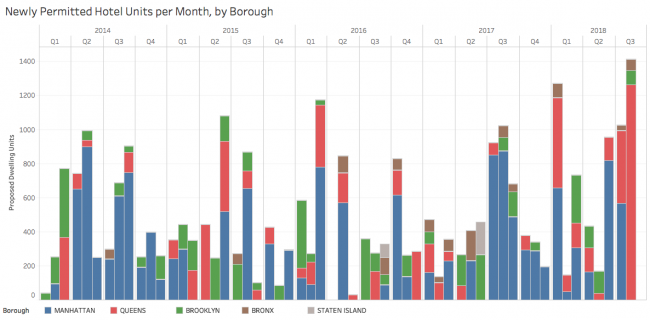

According to an analysis of DOB filings by The Real Deal, August saw new building permits issued for six Queens hotel projects totaling 1,263 dwelling units, the highest numbers on record for any one borough in any one month. The previous records were held by Manhattan, which had five hotel projects kick off in April 2012 and put 1,145 hotel units into the pipeline in March 2008. Outside of Queens, Brooklyn and the Bronx each had just one new hotel project come online in August, while Manhattan had none.

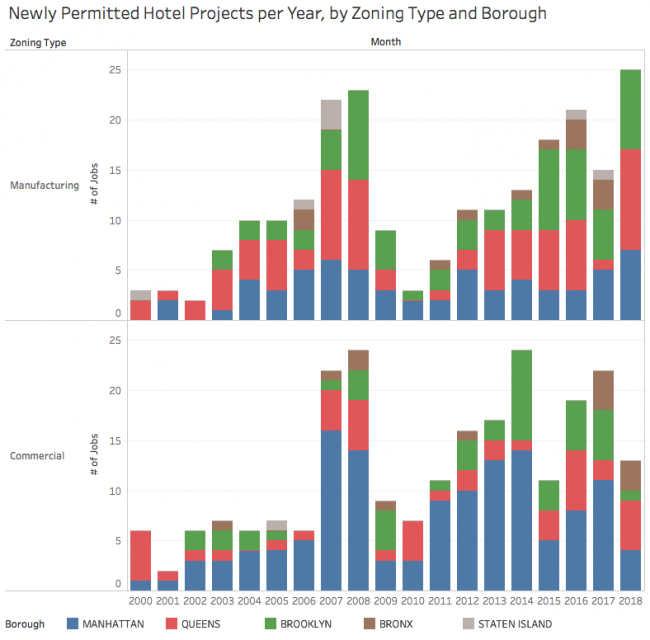

At the end of September, New York’s City Planning Commission is tentatively expected to vote on a zoning amendment that would require a special permit for further construction of hotels in M1 (light manufacturing) districts – although a city planning told TRD that “this is subject to change depending on the analysis and potential modifications to the proposal.” This means that the Queens hotels permitted in August – five of which are indeed located in M1 zones – could be among the last M1 hotel projects to be built on an as-of-right basis.

According to the city’s zoning rules, hotels can generally not be built in residential areas or medium-to-heavy manufacturing zones. This means that the remaining options are either commercial or light manufacturing districts. While Manhattan has an abundance of commercial zoning districts near transport hubs, these are harder to come by in the outer boroughs – which has led to more hotel construction in M1 zones.

The origins of the M1 Hotel Text Amendment can be traced to Mayor de Blasio’s 10-point action plan to grow industrial and manufacturing jobs in NYC, unveiled in 2015. Specifically, Point 2 of the action plan aimed to “Limit New Hotels and Personal Storage in Core Industrial Areas to Reduce Use Conflicts and Support Diverse Economic Growth.” While originally focused on so-called Industrial Business Zones (IBZs) only, the scope of the amendment later expanded to cover most M1 districts in the city, but excluding areas near the airports, for example.

While the borough boards of Queens, Brooklyn, and Manhattan all voted in favor of the amendment in July, the Real Estate Board of New York has voiced its opposition to the changes, claiming that the amendment “appears to be motivated by factors unrelated to sound planning.” While the outcome of this month’s vote may still be unclear, it seems that hotel developers aren’t taking any chances.

Queens has historically been the city’s second largest hotel market after Manhattan, thanks to its two major airports. However, most recent growth has been concentrated in Long Island City’s manufacturing districts instead. August’s crop of new construction reflects this trend – while one of the newly-permitted hotels is located right next to JFK in Ozone Park, the other five are all clustered within a five-block radius in Long Island City:

Five of the Queens hotels permitted in August are clustered in a light manufacturing zone in Long Island City. (Credit: Google Earth)

With four months left to go in the year, 2018 has already set a few annual records in hotel construction, thanks in part to the August bump. Citywide, new hotel projects permitted so far this year are expected to add 5,996 new rooms, surpassing 2008’s record of 5,949 rooms. On a borough-by-borough basis, Queens is set to double its previous high by adding nearly 2,800 hotel rooms this year, versus the previous high of 1,408 new rooms in 2015 – all while other boroughs have been having a down year so far. New hotel construction in M1 districts has already broken records this year as well, with 25 new projects and 3,581 new rooms, though of course this could turn out to be one last hurrah before the M1 zoning amendment kicks in.

The Department of City Planning will make some allowances for projects in progress when (or if) the amendment takes effect: “hotel developments with a building permit or partial permit issued by the Department of Buildings before the referral date of the proposed action would be permitted to start or continue construction as long as they complete their construction and obtain a certificate of occupancy within three years of the date of adoption of the proposed zoning text amendment.” Since the average hotel takes about two years and nine months to get from permit to certificate of occupancy – noticeably longer than other types of buildings – hotel projects permitted just before the M1 amendment would be cutting it bit close, but most should still be able to avoid penalties.

This wouldn’t be the first time impending policy shifts have triggered a permitting rush. In 2015, the expected expiry of the 421a tax exemption created massive spikes in building permits as well.

In a study commissioned by the Department of City Planning last year to support the M1 hotel zoning amendment, demand for additional hotel rooms in Queens – excluding those already under construction – was projected to reach just 1,100 rooms in 2028. If those projections are accurate, then August’s batch of 1,263 rooms will already be enough to satisfy that surplus – and no additional hotels need to be built in Queens for the next 10 years.