Trending

Lawsuit accuses Wynn Resorts of rigging Boston casino competition

Company is seeking more than $1B in damages

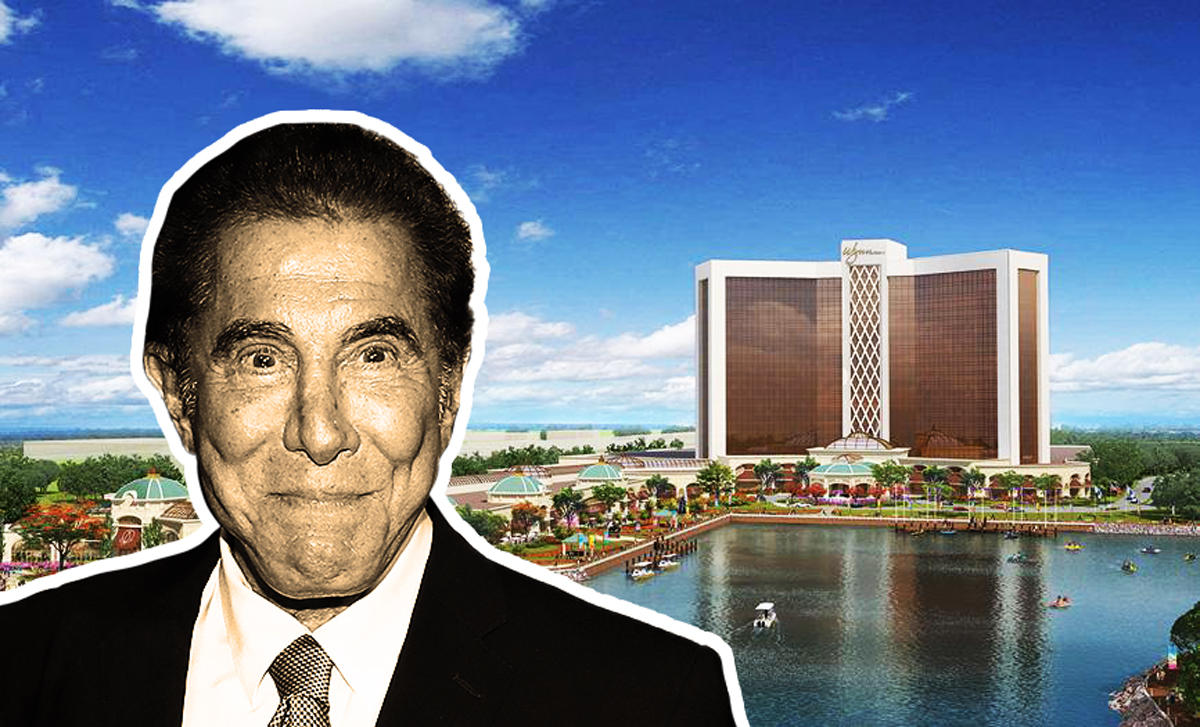

A Massachusetts racetrack operator has accused Wynn Resorts and its former chief executive, Steve Wynn, of rigging a competition to run the only casino in the Boston area.

Sterling Suffolk Racecourse has filed a lawsuit against Wynn alleging that the company cheated its way to being awarded the right to run Encore Boston Harbor in Everett, Bloomberg reported. The lawsuit accuses Wynn of suppressing voter turnout for a casino referendum in Suffolk County — where Sterling proposed to build the casino — and making campaign contributions during the application period. Sterling also alleges that Wynn lied about its knowledge of ties between the project site’s owner, FBT Everett Realty, and organized crime. According to Sterling, the Everett location was previously owned by former associates of La Cosa Nostra.

FBT, Wynn CEO Matthew Maddox and General Counsel Kim Sinatra are also named in the lawsuit. Sterling is seeking more than $1 billion in damages. But because the lawsuit accuses Wynn of violating the federal Racketeer Influenced Corrupt Organization Act, that amount could triple.

Sterling argues that the application for the license to run the casino — submitted by its partner, Mohegan Sun Casino — was superior to Wynn’s.

“This lawsuit was brought by Richard Fields, an unsuccessful applicant for the license awarded to Wynn Resorts. His claims are frivolous and clearly without foundation,” Wynn Resorts said in a statement. Fields heads Coastal Development, which is a major investor in Sterling.

The lawsuit comes as the Massachusetts Gaming Commission considers whether or not Wynn will ultimately be permitted to run the casino. The company won the rights to operate the $2.5 billion facility in 2014. But in February, Steve Wynn resigned from the company after multiple allegations of sexual misconduct were reported by the Wall Street Journal. He’s denied the allegations. After the allegations surfaced, the gaming commission removed Wynn Resorts’ name from the project. [Bloomberg] — Kathryn Brenzel