With companies like WeWork, Knotel and Spaces gobbling up real estate to feed their voracious expansion plans, co-working and flexible-space tenants have tripled their share of Manhattan’s office-leasing activity over the past year.

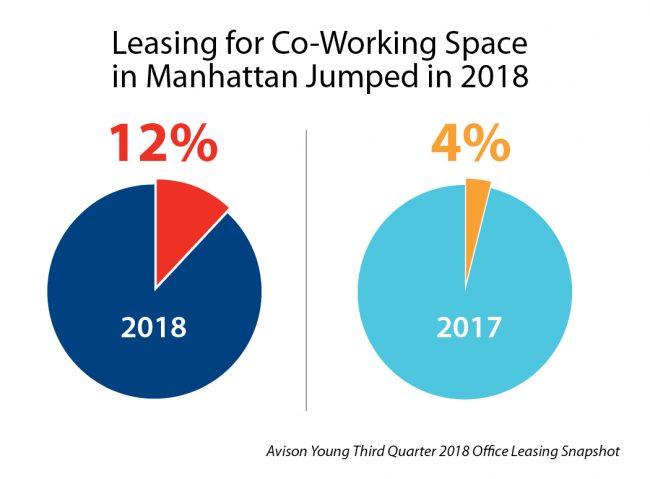

Co-working tenants inked 12 percent of the nearly 25 million square feet worth of leases signed in Manhattan through the first three quarters of the year, according to Avison Young. That’s up from 4 percent during the same time period last year.

Mitti Liebersohn, president and managing director of Avison Young’s New York City operations, said the stronger leasing activity “reflects that co-working operators are now securing leases in Class A buildings as well as Class B and C properties, a trend we saw across all markets in the third quarter.”

WeWork, for example, recently signed a nearly 80,000-square-foot expansion at 85 Broad Street in the Financial District, where it’s launching its “WeWork Wellness” gym. The company, which is backed by SoftBank and reportedly seeking new funds at a $35 billion valuation, is now Manhattan’s largest private office tenant with a portfolio totaling 5.3 million square feet.

In Midtown South, co-working companies accounted for 45 percent of the 1 million square feet leased during the third quarter, overtaking the 23 percent of leases signed by the submarket’s traditional tenants in the technology, advertising, media and information-services (TAMI) sector.

All of that co-working activity may give some pause for concern, though. A recent study by Cushman & Wakefield found that investors consider properties with large exposures to WeWork as riskier bets than those with smaller percentages leased to the company.