Trending

Trinity looks to sell leasehold for Hudson Square development site

Ground lease could be worth $180M or more

Trinity Real Estate is looking to ground lease one of its Hudson Square development sites in a deal that could be worth $180 million or more.

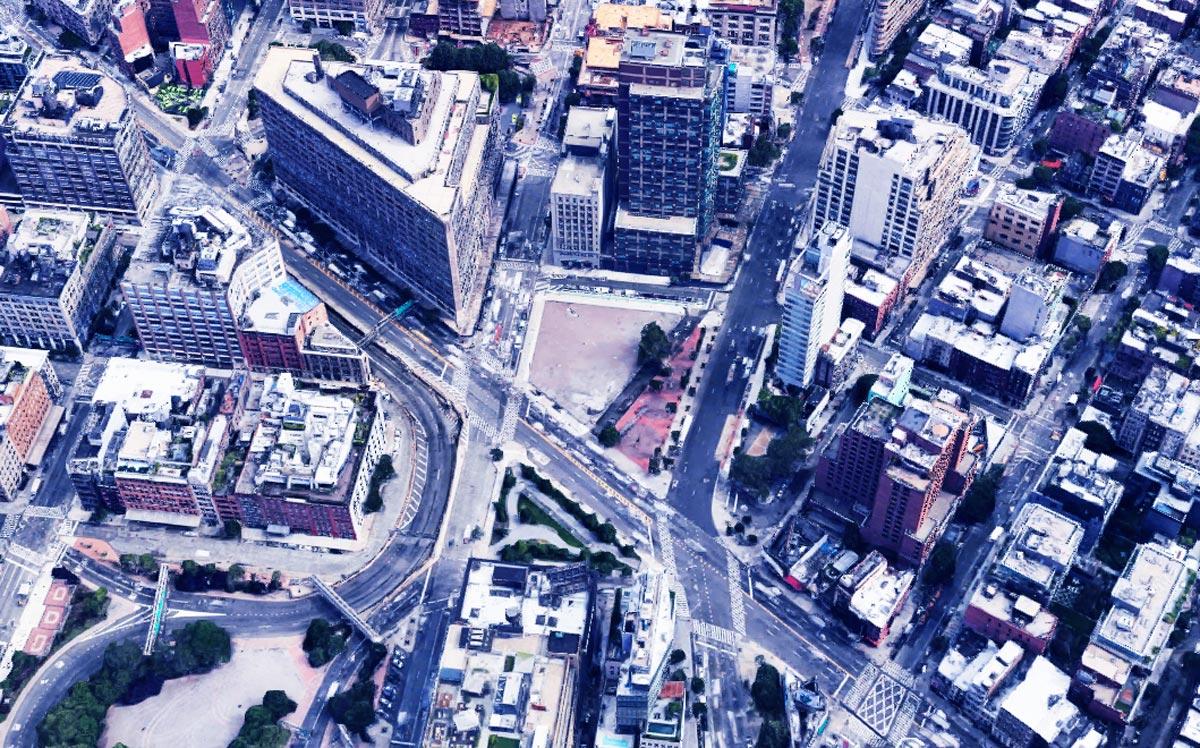

The company, the real estate arm of Trinity Church, put the development site at the corner of Canal Street and Sixth Avenue, known as 2 Hudson Square, on the market, Crain’s reported.

CBRE’s Darcy Stacom has the listing.

Trinity is offering control of the property through a long-term lease – most likely for a term of 99 years – where an investor could develop roughly 300,000 square feet of residential space.

It wasn’t clear what Trinity is valuing the site at in terms of upfront payments or rent. But one source told Crain’s the leasehold position could be valued at $180 million or more.

The city unlocked the development potential through a 2013 rezoning initiated by Trinity.

Trinity recently struck a deal to ground lease the site at 4 Hudson Square for $650 million to the Walt Disney Co., which plans on building a new headquarters after selling the Upper West Side offices of ABC to Silverstein Properties for $1 billion.

In 2015, Trinity sold a 44 percent stake in a 75-year ground lease controlling its 5 million-square-foot Hudson Square portfolio to the Norwegian sovereign wealth fund Norges for $3.55 billion.

The development sites at 2 and 4 Hudson Square were not part of that portfolio. [Crain’s] – Rich Bockmann