Trending

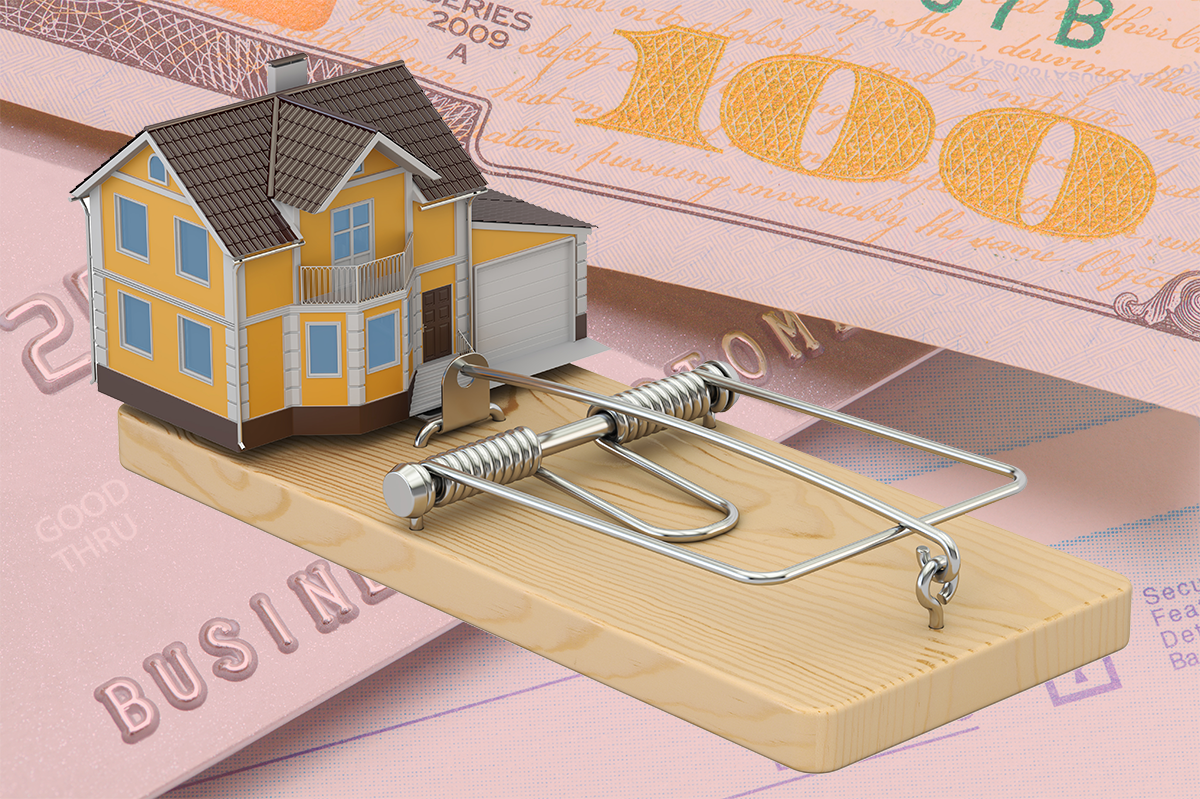

Fraud alert: Bogus mortgage applications are on the rise

Borrowers use scam websites to help "verify" inflated incomes

Mortgage fraud is on the rise as more buyers are inflating their incomes in order to qualify for new purchases.

Roughly one in every 109 mortgage applications has some indication of fraud, according to data from CoreLogic cited by CNBC.

Mortgage fraud risk climbed 12 percent in the second quarter from a year earlier. And areas like New York, New Jersey, Florida, Washington, D.C. and New Mexico are most at risk.

Bridget Berg, principal of fraud solutions strategy for CoreLogic, said rising home prices and strong demand has put pressure on bona fide borrowers to qualify for a mortgage.

“Undisclosed real estate liabilities, credit repair, questionable down payment sources and income falsification are the most likely misrepresentations,” she said.

The biggest cause for fraud risk was inaccurate income reporting. The practice shot up 22 percent year over year, and it’s now easier than ever for fraudsters. Borrowers can use online services that will create fake pay stubs and answer phone calls to “confirm” income.

“Sites will have a disclaimer, claiming it’s for novelty purposes or similar qualifying statements,” Berg said. “Some are out of the country and not traceable. There are sites where you can buy credit lines to increase your credit.”

CoreLogic’s survey also found that loans coming from wholesale lenders or brokers have a higher risk of fraud, which was common during the last housing boom. [CNBC] –Rich Bockmann