Trending

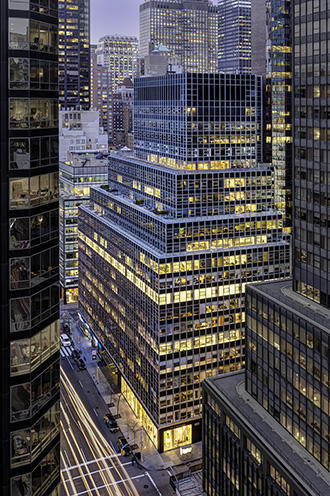

Facing federal scrutiny, HNA in contract to sell 850 Third Ave

Multiple sources said the buyer was Joe Chetrit

After facing federal scrutiny about its ownership of 850 Third Avenue, embattled Chinese conglomerate HNA Group is in contract to sell its stake in the Midtown office tower, according to sources familiar with the deal.

Multiple sources told The Real Deal that the buyer is Joe Chetrit’s Chetrit Group, while additional sources said it was a member of the Chetrit family. Isaac Chetrit, who runs the real estate investment company AB & Sons, denied involvement in the deal. Joe Chetrit did not immediately respond to a request for comment.

It wasn’t immediately clear how much Chetrit is paying for the property, but two sources said HNA will not make a profit on the sale. The firm paid $463 million for the 21-story, 617,000-square-foot tower in 2016, amid an acquisition spree that saw it pick up a bevy of trophy Manhattan skyscrapers.

It wasn’t immediately clear whether minority owners MHP Real Estate Services and ATCO Properties and Management are also selling their stakes in the property.

If it closes, the deal would be the second significant office tower purchase for the Chetrit Group in recent months. Last month, the firm bought office tower 1231 Third Avenue and a nearby assemblage for $142 million.

The sale of 850 Third comes after the U.S. government scrutinized HNA’s stake in the property over the summer. The Committee on Foreign Investors in the United States reportedly notified the Chinese conglomerate that had concerns about the “unique facts and circumstances” of the property’s location.

In August, the New York Post reported that the federal government planned to seize HNA’s stake in the property, but the company denied that report. The New York Police Department’s 17th Precinct, which is occasionally involved in guarding Trump Tower, occupies space in the building.

Later that month, Bloomberg reported that HNA was in talks to sell its stake to the Caiola family’s B&L Management at a $452 million valuation.

HNA refinanced the building with a $342 million loan from Natixis this June.