Trending

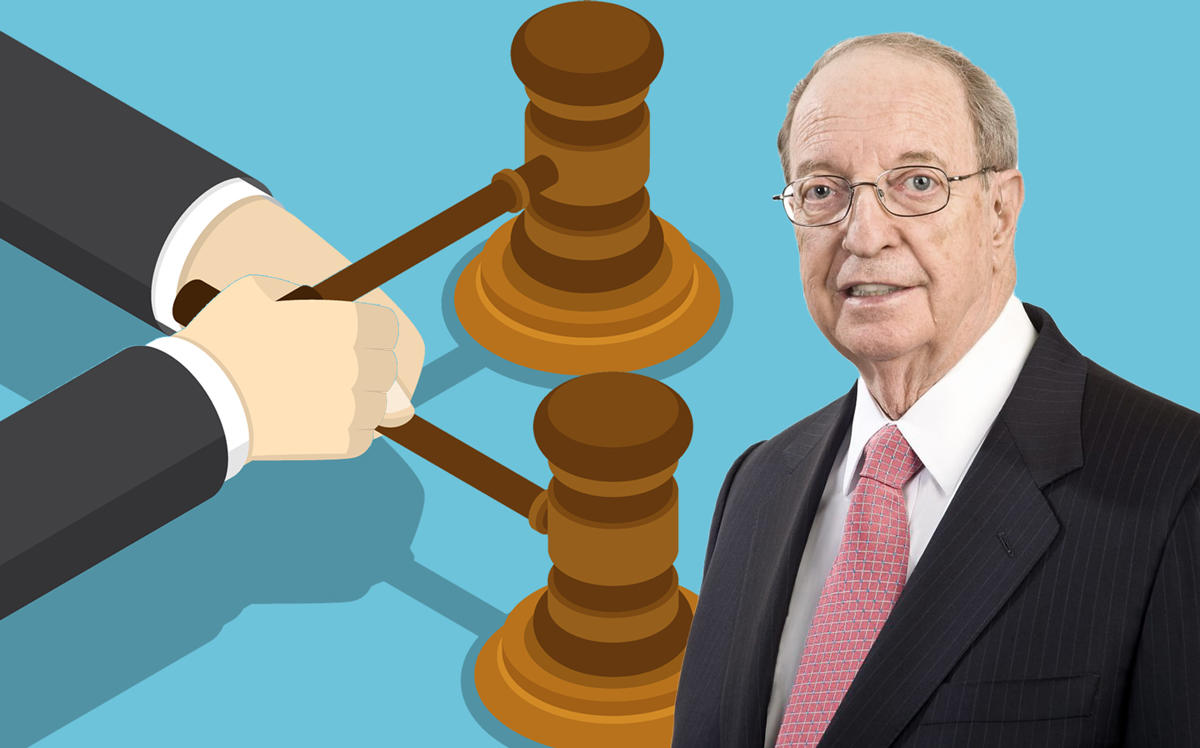

Judge clears the way for Forest City vote on Brookfield deal

Shareholders will vote on $6.8B

An Ohio federal judge ruled that Forest City Realty Trust’s shareholder vote on Brookfield Asset Management’s acquisition of the company can go forward.

Judge Christopher Boyko on Wednesday denied Albert Ratner’s request to temporarily halt the vote on the company’s sale. Ratner, formerly CEO of Forest City, had filed a lawsuit on Monday, alleging that the Brookfield deal gave up $5.8 billion in shareholder value. He sought to delay the vote, which is scheduled for Thursday, until after Forest City issued a corrected proxy on the deal. In the lawsuit, he alleged that the company’s board had withheld important information about the real estate investment trust’s financials.

In a response filed on Wednesday, Brookfield and Forest City called Ratner’s complaint an “eleventh-hour, fire-drill litigation.” The judge found that Ratner “failed to establish irreparable harm and a strong likelihood of success on the merits.”

In July, Brookfield announced that it would buy Forest City for $6.8 billion. Forest City had rejected an early bid in March, choosing instead to reorganize the company’s board. According to Ratner’s lawsuit, Brookfield submitted a new offer for the REIT on the same day the new board was elected.