When Amazon announced earlier this month that it would be putting one half of its new “headquarters” in Long Island City, it drew even more attention to a neighborhood already in the midst of a major construction boom.

The news set the real estate world abuzz, and the market reacted immediately. But while condominium sales seem to have flipped from a buyers’ to a sellers’ market overnight, the rental world’s response has been more muted.

“In a nutshell, there aren’t enough condos and there’s too many rentals” in Long Island City, said Jonathan Miller, CEO of appraisal firm Miller Samuel. Amazon’s arrival will impact different segments of the residential market in different ways, and some residential brokerages are better positioned to benefit than others.

To better understand the lay of the land at the outset of the Amazon era, The Real Deal analyzed hundreds of rental and condo listings on StreetEasy to see which brokerages have the most to gain from increased interest in the neighborhood — and caught a glimpse of how the market is already adapting to a new reality.

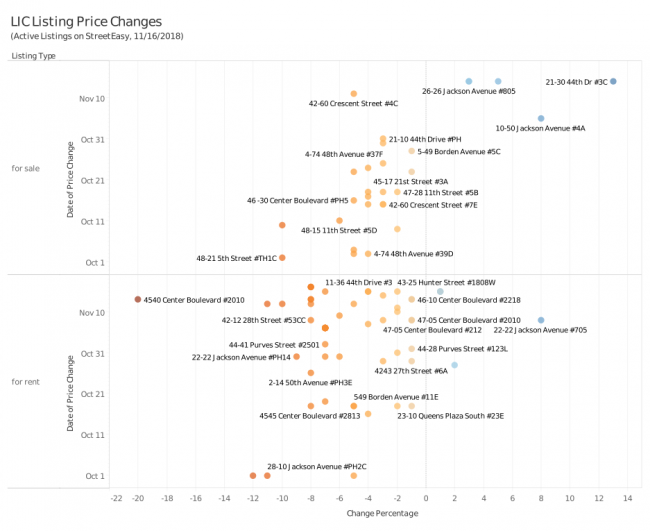

While the LIC sales market has seen an immediate turnaround after the Amazon news, price cuts in the rental market have continued apace.

A sudden pricing surge

Buyer activity has risen dramatically since news leaked that Amazon would plant a flag in Long Island City.

Halstead’s Jonna Stark, who also lives in the neighborhood, said there were four times as many people at her open houses last weekend than the previous three weekends.

“The market has been soft, and many buyers were waiting for the bottom,” she said. “Now it looks like the bottom’s not going to come.”

Carlos Simoes, a broker with Modern Spaces, said he’s “already seen a 500% increase in weekly appointments and a significant increase in sales pace.” Two of Simoes’ Long Island City listings at 21-20 45th Road saw 3 percent price hikes last week. Two blocks away, another Modern Spaces listing at 21-30 44 Drive increased its asking price by 13 percent.

For comparison, the entire month of October saw zero price increases and 25 price decreases neighborhood-wide.

This uptick has added a sense of urgency to buy now before prices climb further. One resale listing had a line out the door for showings last weekend, an agent said. And even at 8 p.m. on a Saturday, Modern Spaces’ Vernon Boulevard office was packed.

“Every desk was full with people working,” said CEO Eric Benaim.

Some buyers have already accepted higher prices. One broker said their buyer had agreed to a price for a condo in the neighborhood — but following the news, the deal, still in the works, is being renegotiated. And, while much of the city’s sales market has been plagued by price cuts, this buyer is willing to shell out more for LIC apartment.

The negotiation factor has essentially disappeared, according to data compiled by Stribling. Listing discounts in the neighborhood averaged 3 percent this year through August.

“It’s like someone hit a switch,” said Patrick Smith, an agent at Stribling. “The listing price is what it is.”

While it’s difficult to quantify exactly how many units have gone into contract since the Amazon announcement, brokerages have reported higher deals activity. Modern Spaces said it has deals in the works at nearly 200 units in the neighborhood — including properties that can’t be accurately quantified because they haven’t been officially put on the market. “Around half” are signed contracts, Benaim said. Stribling declined to provide specific numbers but said signed contracts have “increased significantly” compared with the same time last year as well as the weeks prior to the Amazon news.

Among Elliman’s listings, the brokerage said it has negotiated “dozens of offers” — eight of which have been accepted. Nest Seekers had three units in contract, with another three in negotiation, as of Wednesday. Halstead reported 16 new contracts, and there were 13 deals among Compass listings.

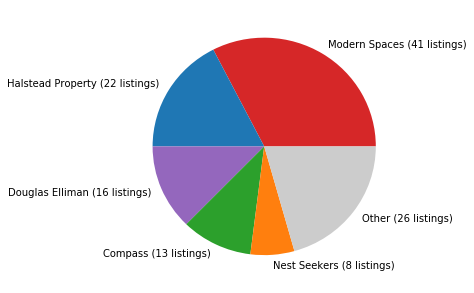

Modern Spaces stands to gain more than any other brokerage from the arrival of Amazon and the commensurate interest from buyers. Among the active sales listings analyzed by TRD, Modern Spaces accounted for 32 percent, with 41 apartments totaling over $45 million in listings volume as of Nov. 16.

Top Sales Marketers in LIC, by number of listings

Other big players in the neighborhood include Halstead, Douglas Elliman and Compass.

Meanwhile, rental listings have not responded quite as positively to the prospect of thousands of new residents. Rather than tightening the rental market in Long Island City, this influx might merely ease the serious oversupply the neighborhood currently faces.

“In some ways, I look at it as a bail out for existing developers, and what they’ve done over the last four or five years,” said Miller. Ten thousand more units are already expected to come online over the next two years, he added.

Overspill from the Brooklyn market, as well as easy access to capital and affordable development sites, have been some of the driving factors behind this influx of new development.

From Tuesday, Nov. 14 (when the news broke) through Friday, Nov. 17, the vast majority of price changes on Long Island City rental listings continued to be trending downward — 18 listings saw their prices slashed in that time, while just three listings saw increases, none of which exceeded 1 percent.

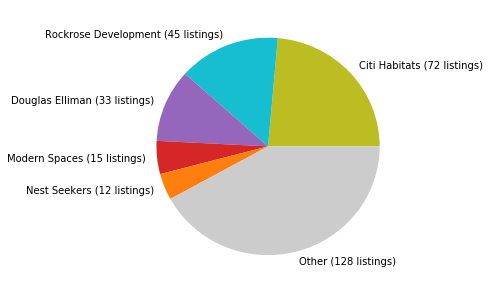

Top Rental Marketers in LIC by number of listings

Currently, the most active rental brokerage in Long Island City is Citi Habitats, which had 72 rental units listed as of last Friday, followed by Rockrose Development’s in-house team, and Douglas Elliman. (It should be noted that some firms do not advertise rental listings on StreetEasy due to the $3 daily fees.)

David Maundrell, Citi Habitats’ executive vice president of new developments in Brooklyn and Queens, said that despite the surge in interest, the industry should take the news with a grain of salt.

Amazon’s move to the neighborhood will boost home prices and retail development, he said. And it may draw other prominent companies to the area. But it won’t all happen overnight — and buyers will consider other locations as well, Maundrell said. Especially since Long Island City is in an accessible location.

“It will become a true community, but Long Island City is not for everybody,” he said. “People will weigh other options.”

Other neighborhoods likely to see a ripple effect from the move are Astoria and Greenpoint, he said.

“Over the last 10 years, I’ve seen Long Island City less as a neighborhood and more as a collection of new buildings,” said Miller, noting how stores and other residential support services continue to be sparse in the area. “The higher density of residential occupancy that this could bring might really help seal the deal.”

Maundrell also noted that the added spotlight on Long Island City is unlikely to significantly change the brokerage dynamic. Most major players have a presence there, he said, and some have been established in the neighborhood for several years.

In the long term, Amazon’s arrival in the neighborhood might accelerate the shift from rental to condo development, a process already underway.

“I think over the last year there’s been much more pushback from lenders who have become wary of lending in Long Island City, but this may erase that,” Miller said. “So what we may see is a doubling down on new supply, which offsets the new demand being created — sort of kicking the can further down the road.”