GreenOak Real Estate and Slate Property Group closed on the more than $280 million acquisition of the Biltmore rental apartment tower in Midtown on Tuesday, according to sources familiar with the deal.

The Jack Parker Corporation is the seller. The Real Deal first reported in May that Slate and frequent partner GreenOak were in talks to buy the 52-story, 464-unit tower at 271 West 47th Street.

Newmark Knight Frank’s James Kuhn, David Colen and Michael Byrne brokered the sale. The Newmark brokers and GreenOak could not be reached for comment. Slate referred a request for comment to GreenOak.

Sources previously told TRD that the new owners would consider renovating and repositioning the Biltmore as high-end rentals, though Newmark had also marketed the property as a potential conversion from rentals to for-sale units, with a projected sellout of $473 million. Slate and GreenOak’s plans are unclear.

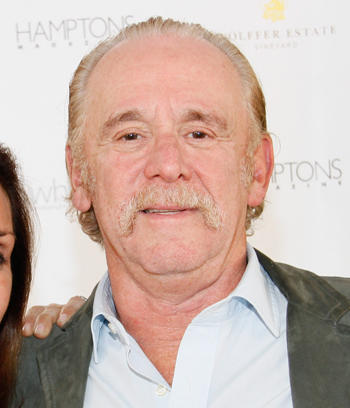

Newmark’s Jimmy Kuhn (Credit: Getty Images)

Jack Parker previously agreed to sell the 291-unit Truffles Tribeca building at 34 Desbrosses Street to Related Companies for $250 million and the Parker Towers housing complex in Forest Hills to the Blackstone Group for around $500 million.

Those sales were also brokered by the Newmark team led by Kuhn. The properties are all part of a seven-property portfolio Jack Parker put on the market earlier this year.

Slate and GreenOak teamed up on the $390 million acquisition of the RiverTower rental building at 420 East 54th Street in 2016.