Trending

TSX Broadway developers land more than $780M in new equity

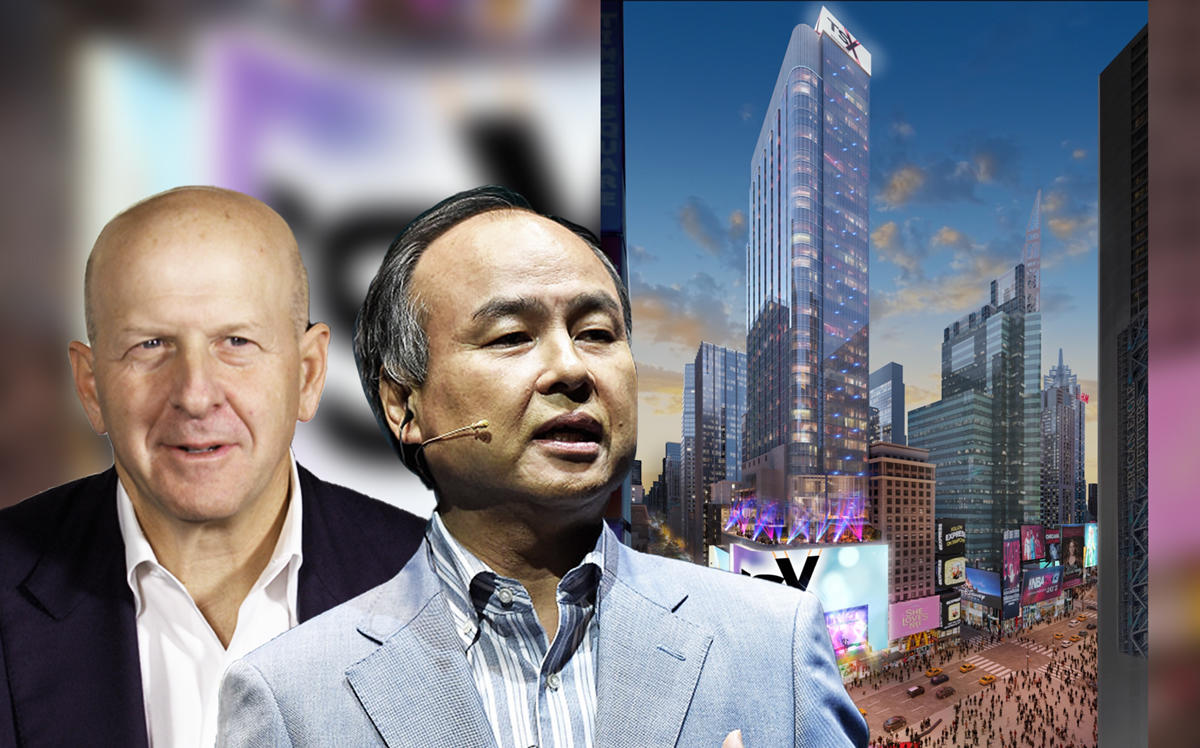

Goldman Sachs provides $1B construction loan for Times Square project

The developers behind Times Square’s TSX Broadway have raised more than $780 million in new equity, valuing the entertainment-and-hotel project in excess of $2 billion.

Among the new investors is a group of ultra-high-net-worth and family office clients of UBS Group AG, which provided roughly $400 million of new equity, according to Bloomberg News, which first reported on the new financing.

“We have seen a substantial increase in interest from our ultra-high-net-worth and family office investors for direct, single-asset real estate investments like TSX Broadway, including potential deployment of billions of dollars of capital gains in opportunity-zone investments,” Donato Giuseppi, head of direct investments in the Americas for UBS Wealth Management, told Bloomberg.

Giuseppi added that this was the largest direct real estate deal that the Zurich-based bank pursued for its clients.

Masa Son’s SoftBank Group is also investing around $200 million.

L&L Holding Company, Fortress Investment Group (which is owned by SoftBank) and Maefield Development are developing the 46-story tower at 1568 Broadway, where construction is set to begin in January. According to a prospectus previously shared with Chinese investors, the developers estimate the project will be worth nearly $4.2 billion by 2023.

L&L co-founders David Levinson and Robert Lapidus, as well as Fortress executives Peter Briger and Dean Dakolias, are also personally investing in the project.

Adam Spies, Doug Harmon and Marcella Fasulo at Cushman and Wakefield represented the sponsors in the capital raise.

The developers also secured a $1.13 billion construction loan for the project from Goldman Sachs. Debtwire first reported news of the loan. An HFF team of Michael Tepedino, Michael Gigliotti and Geoff Goldstein brokered the debt.

The project will feature a 669-key hotel room, 18,000 square feet of signage and 75,000 square feet of retail. [Bloomberg] – Rich Bockmann