Trending

Chinese investors are pulling their money out of the US and Europe

Restrictions imposed by Beijing have raised concerns on a downturn on CRE markets, as interest rates decline

The effects of a retreat in U.S. and European markets by Chinese investors are now being felt, and have stoked concerns of a dip in real estate prices for 2019.

During the third quarter, Chinese conglomerates sold off more than $1 billion worth of commercial real estate in the United States, while purchasing only $231 million, according to the Wall Street Journal. The pull back follows restrictions imposed by the the Chinese government on foreign investments, and experts predict the trend will continue in 2019.

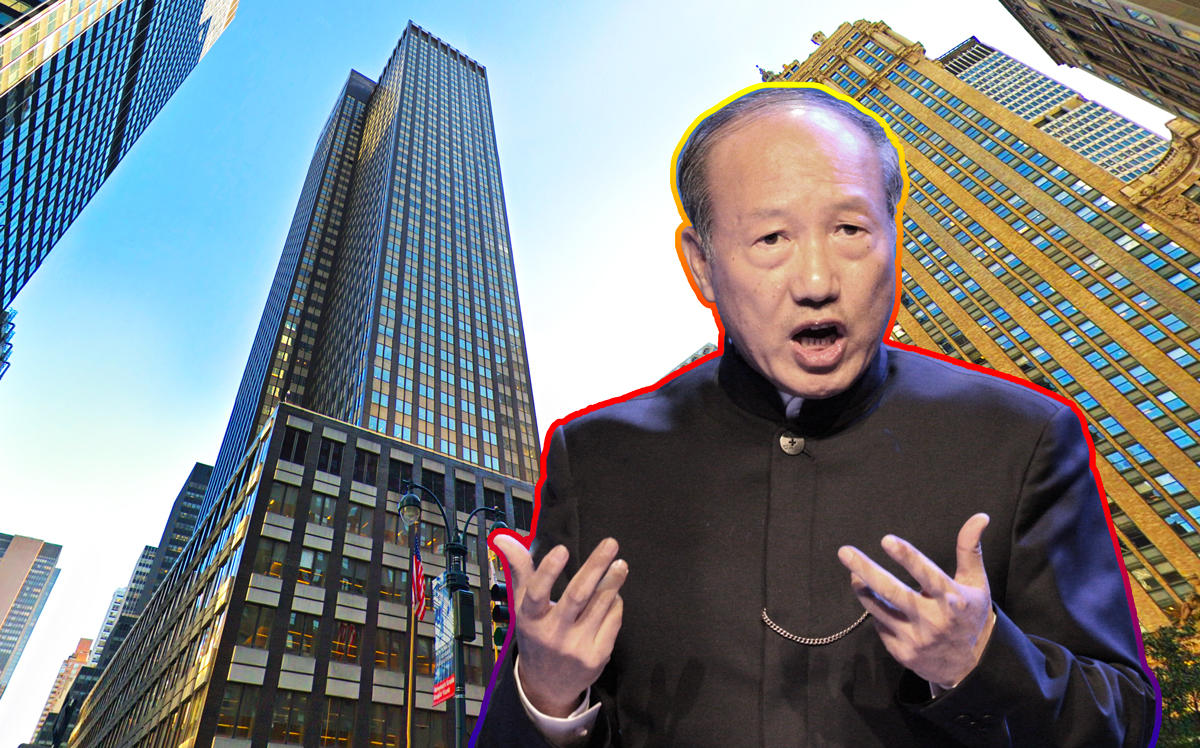

In April, Chinese conglomerate HNA Group announced plans to raise $1.5 billion for an offshore investment fund to continue purchasing as regulators in Beijing seek to constrict overseas transactions.

But in November, the company finalized a deal to sell its stake in 245 Park Avenue to SL Green Realty for $148.2 million. It also sold 1180 Sixth Avenue for $305 million in February.

Another firm, Anbang Insurance Group set a record for the highest amount paid for a U.S. hotel in 2015 when it purchased the Waldorf Astoria in New York for $1.95 billion. It is reportedly attempting to sell a hotel portfolio for $5.5 billion, but the Waldorf is not believed to be included in the sell off.

Supporting concerns of the real estate market in 2019, Green Street Advisors forecasts a “modest” decline in U.S. property prices this year.

“You’re probably going to see some cracks,” Cedrik Lachance, director of Green Street’s REIT research, told the Journal.

The European market has also taken a hit, after Chinese investors offloaded $233.3 million worth of commercial real estate, including hotels and office buildings. They only bought $58.1 million of property during the same period, which appears to be the purchase of London’s historic Royal Exchange building by Fosun International. [WSJ] — David Jeans