The Parkoff Organization has closed on a deal to buy five multifamily buildings in Brooklyn and one in Queens from Morris Weintraub Associates.

The deeds for five of the six properties were recorded with the city on Thursday. No transaction has been recorded for the sixth, a 60-unit apartment building at 150 74th Street in Bay Ridge, but Parkoff’s name appears on associated mortgage documents recorded last week. Representatives for Parkoff and Weintraub could not be immediately reached for comment.

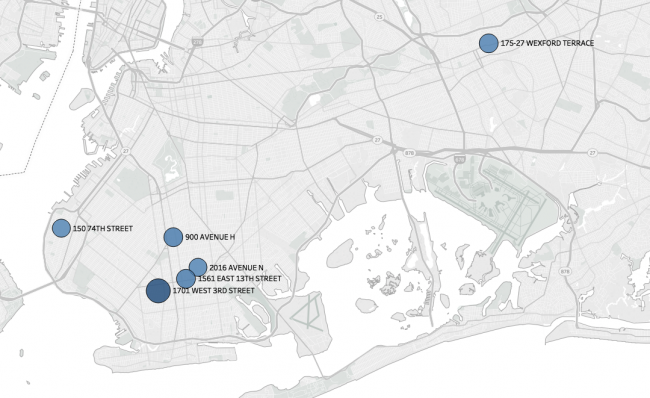

Map of the six properties in the portfolio

Long Island-based Parkoff entered contract to buy the six properties last October for $115 million. The five recorded transactions total $96 million, while the unrecorded Bay Ridge property is likely to have traded for around $19 million.

The largest property in the portfolio is the 107-unit 1701 West 3rd Street in Gravesend, which sold for $28 million.

Three of the other buildings are in the adjacent neighborhood of Midwood: the 66-unit 1561 East 13th Street ($18 million), the 60-unit 2016 Avenue N ($15.8 million) and the 65-unit 900 Avenue H ($17.8 million).

The sole Queens property is the 66-unit 175-27 Wexford Terrace in Jamaica Estates, for which Parkoff paid $16.3 million.

The buildings were built in the 1930s and ’40s and had been in the Weintraub family since the late 1960s. Roughly 97 percent of the 424 units are rent stabilized according to public records.

A Marcus & Millichap team marketed the portfolio on behalf of Weintraub and negotiated both sides of the deal, TRD previously reported.