Trending

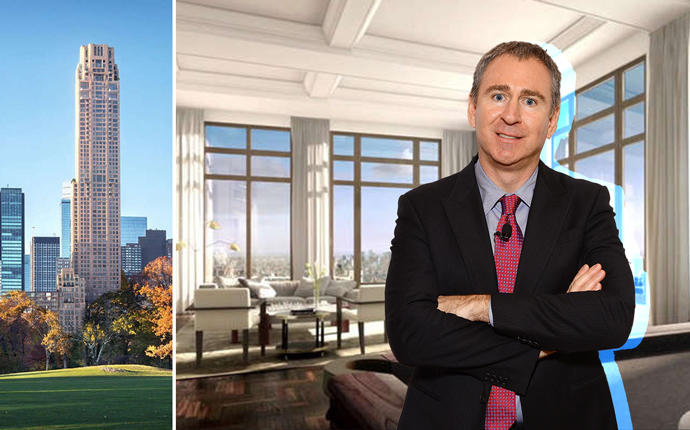

Ken Griffin sets US home record with $238M buy at 220 CPS

It's the most expensive home ever sold in the US

Hedge funder Ken Griffin has closed on a massive penthouse at 220 Central Park South, paying a record-shattering $238 million, according to sources familiar with the deal.

The Citadel founder has long been rumored as the buyer of the condominium’s most lavish spread — a 23,000-square-foot quadplex encompassing the 50th through 53rd floors of the limestone tower, developed by Vornado Realty Trust and designed by Robert A.M. Stern. The asking price was $250 million.

The priciest residential deal to date is a $361 million home in Hong Kong in 2017. While Griffin’s deal falls short of that purchase, it breaks the record for priciest U.S. home sold. Jana Partners’ Barry Rosenstein held that record, having paid $137 million for an estate at 60 Further Lane in East Hampton in 2014. (He later listed it for $70 million in 2017.)

It also shatters the Manhattan sales record: the $100.5 million Michael Dell paid for a condo at Extell Development’s One57 in 2015.

The deal, first reported by the Wall Street Journal, is the latest in a string of eye-popping purchases for the Citadel founder. Earlier this week, he reportedly scooped up a house in London for around $122 million. In 2017, he shelled out $58.75 million for several floors of No. 9 Walton, a condominium in Chicago, and in 2015, set a record in Miami be shelling out $60 million for a penthouse at Faena House.

The Corcoran Group’s Deborah Kern represented Vornado. Douglas Elliman’s Tal and Oren Alexander represented Griffin.