Trending

Clipper Equity gets $136M refi for GWB apartment complex

Debt covers quartet of 32-story towers

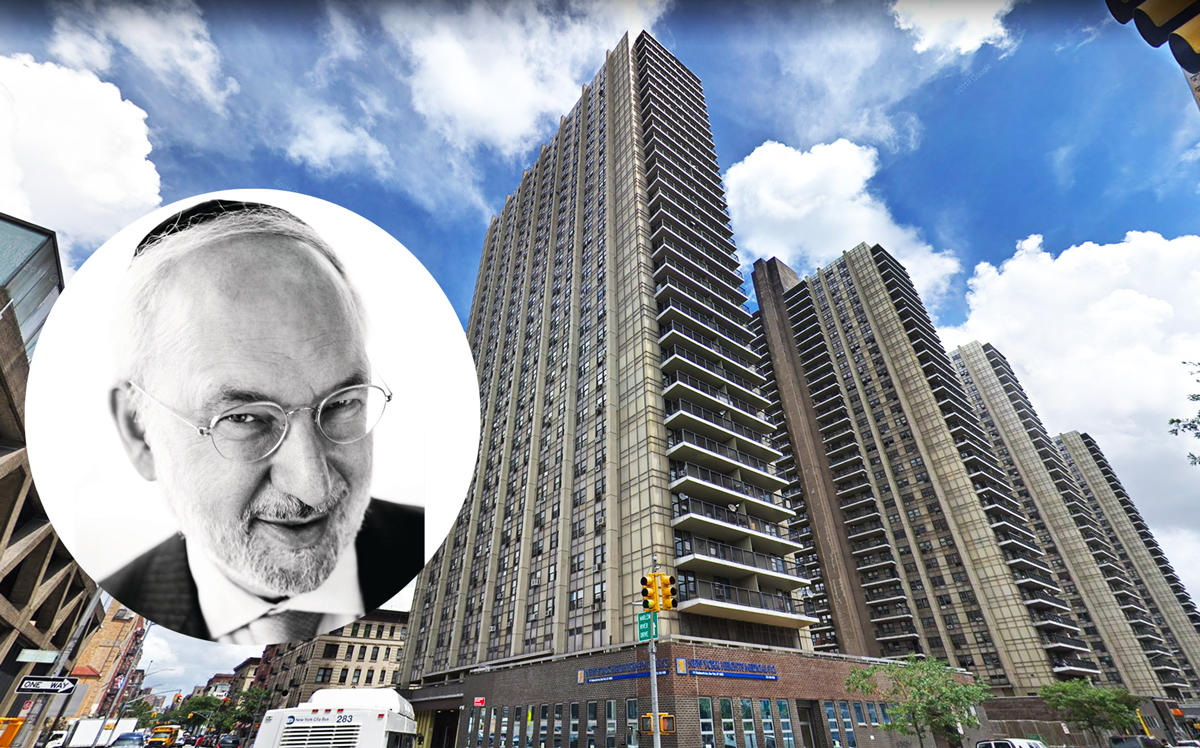

David Bistricer’s Clipper Equity just got a debt injection from Freddie Mac for an apartment complex that straddles the interstate leading to the George Washington Bridge.

The owner entity, which includes investor Jacob Schwimmer, secured a $136 million refinancing of the 480-unit Bridge Apartments at 111 Wadsworth Avenue and 1360 St. Nicholas Avenue, according to filings recorded Tuesday with the city’s Department of Finance. There are four, 32-story buildings in the complex.

The main lender behind the debt is Walker & Dunlop, a Bethesda, Maryland-based commercial real estate finance firm. The deal also includes a $41.8 million multifamily mortgage and replaces financing from New York Community Bank.

The refinancing also secured a fixed-rate term over 10 years, Bistricer said.

“We’re very pleased with the rate,” he said. “We’re very pleased with the execution.”

For Freddie Mac, the move marks another recent multifamily play in Manhattan. Through its small balance loan program, the agency last week provided $189 million to Emerald Equity Group to refinance its Dawnay Day portfolio in East Harlem. It’s the largest deal to date in the SBL program.

The deal’s value trumps another loan Clipper Equity secured in November, when the Brooklyn-based firm and the Chetrit Group locked down a $98.9 million mortgage from Greystone Servicing Corporation for their luxury rental building in Prospect Park South.

Meanwhile, the public arm of Clipper Equity, Clipper Realty, late last year announced its strategy to deregulate units, repurpose some of its buildings and boost rents. The firm highlighted the Aspen Apartments on the Upper East Side as one property where rents could increase following improvements.

As for the Bridge complex, which Bistricer and his parents bought with Schwimmer in the 1980s, the owners are also “putting money in” to the property.

“It’s a constant, ongoing program,” Bistricer said. “Nothing out of the ordinary.”