Trending

Here’s one way to tell if a tower is in trouble

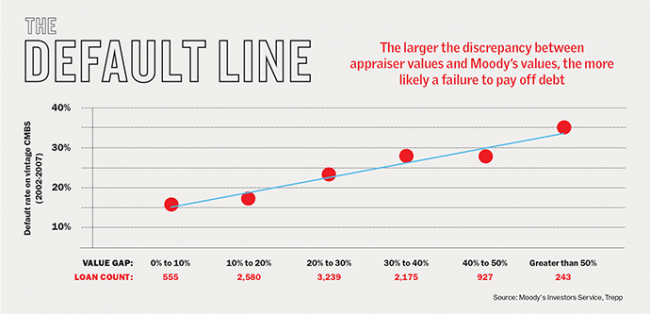

If appraised values are way bigger than what ratings agencies come up with, a building could be more likely to default

Want to understand if a major property is at risk of defaulting on their loans? One way to tell is to look at the difference between private appraisals of the building and those done by ratings agencies.

An analysis of large commercial mortgage-backed securities deals by The Real Deal found that ratings agencies routinely shave more than 20 percent off bank appraisals in the lead-up to bond offerings. In some cases, they may shave up to 50 percent when trying to gauge the true value.

Part of the difference is that ratings agencies look at the worst possible outcomes over the course of a 10-year loan when they give a valuation, said Moody’s CMBS analyst Kevin Fagan. And, according to a recent Moody’s study of loans from years 2002 to 2007, the larger the discrepancy between appraiser values and ratings agency values, the more likely the chance of default.

“For appraisers, the market valuation is about one point in time — often tied to a sales price,” Fagan said. “For ratings agencies, we’re looking for the very stressed version of what may happen in the event of default of these loans that results in a bond loss … the higher the rating, the lower our assumed stress value.”

The root of the problem, insiders say, is a conflict of interest. Appraisers are supposed to be impartial. But they are hired and compensated by people who aren’t, which makes them vulnerable to pressure.

To see the full story from the February issue, click here.