As new development sales continue to struggle, Manhattan resales are getting a boost.

(Credit: Miller Samuel)

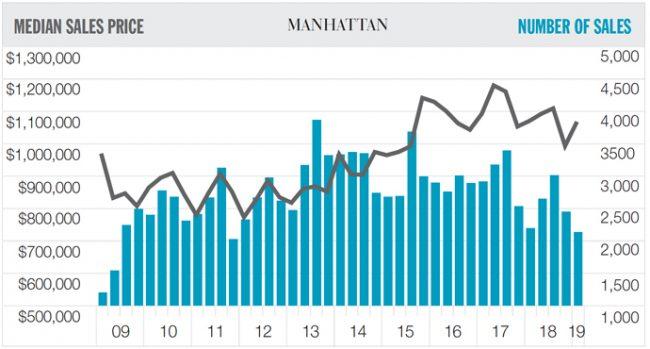

The overall number of sales closed in the first quarter dipped 2.7 percent versus a year earlier while the median sales price fell 0.2 percent, according to Douglas Elliman’s latest market report. Among new development properties, sales volume tumbled 39.4 percent, as the median price ticked up 3.4 percent.

New development closings had the lowest market share in four-and-a-half years, the report said.

“The market’s essentially been consistent with a steady erosion of sales volume,” said Jonathan Miller, CEO of appraisal firm Miller Samuel and author of the report.

In the resale market, the number of sales closed rose 2.2 percent year-over-year, with the median sales price climbing 3.4 percent to $997,750. That was a new record and the eighth straight quarterly increase. The market is “polarized,” Miller said, largely due to differing inventory trends in new development versus resales, where units don’t typically come to market in bulk.

Inventory increased and sales slowed for six consecutive quarters.

“The key characteristic is that the pace of the market is cooling,” Miller said. “Supply keeps growing and buyers have had an elevated sense of uncertainty” about things like financial market volatility and the proposed pied-à-terre tax — which ultimately didn’t pan out, though a one-time transfer tax was added.

Ken Griffin’s record $238 million purchase at 220 Central Park South skewed the pricing average in the report. During the quarter, the average sales priced was pushed up 9.8 percent to $2.1 million.