Trending

WeWork signed four leases this week for its “headquarters” offering

The flexible-office giant is doubling down on its un-branded sites for mid-size tenants

In its quest to gobble up as many leases as possible, WeWork has signed another four locations in Manhattan this week for its “headquarters” offering.

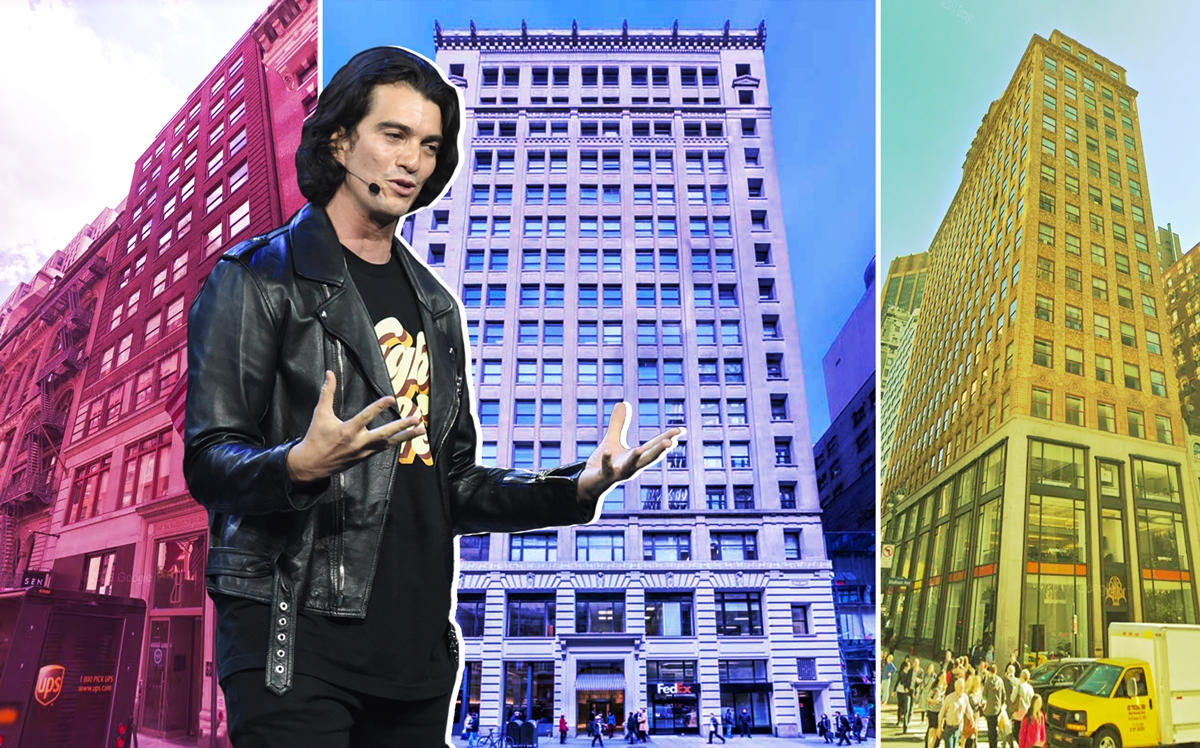

The flexible office space giant, which is signing dozens of deals as it gears up for an initial public offering, inked leases with APF Properties on four Manhattan locations totaling 110,000 square feet, the firms said Thursday. The spaces, at 25 West 45th Street, 28 West 44th Street and 183 Madison Avenue, will be filled with Headquarters by WeWork, which provides un-branded spaces for mid-size clients. Asking rents were not immediately available.

APF, which is led by Kenneth Aschendorf and Berndt Perl, now has WeWork in five of its seven properties, including 115 Sixth Avenue and another location in Philadelphia.

“WeWork is exactly the type of firm we would want to have across our portfolio,” said Aschendorf. “Even if it meant additional costs to relocate our tenants.”

He added that “four or five” tenants were relocated to get WeWork into the spaces.

WeWork also said Wednesday that it signed a lease with the Adler Group, for a roughly 52,000-square-foot space at 550 Seventh Avenue. Both parties were represented by the Kaufman Organization in that deal. Earlier this month, WeWork closed on a 50,000-square-foot lease at 30 Wall Street for its headquarters business.

WeWorks’ parent company the We Company revealed last week that its losses doubled during the first quarter. The $47 billion company reported $689 million in revenue, more than double that of the first quarter of 2018. Its net losses totaled $264 million, a figure that the company said was offset by more than $240 million in two one-time gain payments.

But the We Company’s adjusted EBITDA losses more than doubled, rising to $220 million from $106 million year over year. That figure included $31 million in merger and acquisition fees and inventory write-off costs, the We Company said. The firm said its total cash and cash commitments dropped to $5.9 billion, down from $6.6 billion at the start of the year.

The firm’s total member count jumped to 466,000 individual customers in the first quarter, during which time WeWork added 50 locations.