Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page at 9 a.m., 12:30 p.m., and 4 p.m. ET. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4 p.m.

Discount brokerage Redfin’s revenue rose 39% in the second quarter. The Seattle-based firm’s new iBuying platform helped push revenues, but steep marketing costs resulted in net losses growing from $3.2 million to $12.6 million. [TRD https://therealdeal.com/national/2019/08/02/ibuying-pays-off-for-redfin-as-revenue-soars-39/]

Smart-lock maker Latch made off like a bandit with a $126 million Series B fundraise. According to the startup, one in 10 new apartment buildings in the country use its smart locks, and investor Brookfield has said they plan to install latch at Greenpoint Landing. [TRD https://therealdeal.com/national/2019/08/02/latch-raises-126m-to-complete-series-b-funding-round/]

Seritage, the real estate investment trust formed in 2015 to overhaul Sears-anchored real estate, posted a nearly $26 million net loss in the second quarter. The department store is in the middle of bankruptcy proceedings and is also embroiled in a lawsuit against its former CEO, Eddie Lampert. [TRDhttps://therealdeal.com/national/2019/08/02/amid-sears-bankruptcy-seritage-posts-26m-net-loss-in-q2/]

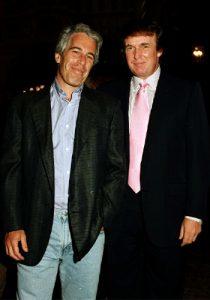

Jeffrey Epstein and Donald Trump in 1997 (Credit: Getty Images)

Donald Trump and Jeffrey Epstein sparred over the Florida estate of nursing home mogul Abe Gosman in 2004. Gosman originally purchased from Epstein’s close friend and mentor Leslie Wexner. But after Gosman went bankrupt, Trump out-bid Epstein for the property, and flipped it just four years later for $95 million. [Vanity Fair]

WeWork has been negotiating for up to $6 billion in financing, but there’s a catch. The financing is contingent on the We Company raising $3 billion when it goes public. JPMorgan Chase has reportedly already promised $800 million. [Bloomberg]

The controversial Two Bridges megadevelopment is headed for ULURP. A judge nullified the previous approvals for the towers. Developers CIM Group, L+M Development Partners, Starrett Development and JDS Development Group planned 2,775 apartments, 25 percent of which would be set aside as affordable. [The City]

Marx Realty has gotten a $140 million refinancing on 10 Grand Central. The debt carries a a rate of 3.99 percent and a loan-to-value of 30 percent. The firm embarked on a $45 million renovation process last July. [CO]

Alfred Sabet’s Sabet Group picked up a six-story Soho building for $21.3 million. The deal for the cast-iron building at 457 Broome Street was brokered for the seller by Meridian Capital Group. [CO]

Co-living startup Bedly, which abruptly closed shop, found a company to take over its subleases. Brooklyn-based Outpost Club will take over some of the lease agreements in Manhattan and New Jersey. In all, Bedly has 600 tenants and had raised $7 million. [TRD]

Elegran Real Estate is going after Compass. Elegran, which was found of running its own network of knockoff building sites, claims that leasing manager Zino Angelides and three other Elegran agents took over $2 million worth of data to the $6.4 billion real estate brokerage. [TRD]

Compiled by Georgia Kromrei

FROM THE CITY’S RECORDS:

Residential sales:

An anonymous buyer acquired a unit at 220 Central Park South in Midtown for $24.1 million. [ACRIS]

Financing:

The New York State Housing Financing Agency provided a $158.34 million leasehold mortgage for NYCHA’s Hope Gardens portfolio of 15 Brooklyn buildings in Bushwick. [ACRIS 1, 2]

Compiled by Mary Diduch