Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page at 9 a.m., 12:30 p.m., and 4 p.m. ET. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4:00 p.m.

733 Third Avenue and Durst Organization president Jordy Durst (Credit: Google Maps and Durst Organization)

A tax firm is taking four-plus floors at Durst’s 733 Third Avenue. Accounting and advisory firm EisnerAmper signed a lease for nearly 125,000 square feet on the sixth through ninth floors, plus part of the 10th floor in a 15-year deal. Asking rent was $69 a foot. [TRD]

An ex-Empire State Realty Trust exec says she was fired for complaining about age discrimination. Audrey Pass, former chief marketing officer at the real estate investment trust, is seeking $5 million in damages. In one instance, ESRT CEO Anthony Malkin allegedly blamed a failed meeting on the fact that he and Pass were “too old and too white.” [TRD]

Little St. James Island (Credit: Navin75 via Flickr)

The FBI swarmed Jeffrey Epstein’s private island. The agency, along with local police from the Virgin Islands and New York Police Department officers, drove around Little St. James Island in golf carts and gathered evidence following Epstein’s apparent suicide in Manhattan jail on Saturday. Epstein allegedly trafficked girls through his island home. [Miami Herald]

313-331 Bond Street in Gowanus (Credit: Google Maps and iStock)

Rabsky Group, a major player in Brooklyn real estate, is making a bet in Gowanus. The firm, headed by Simon Dushinsky and Isaac Rabinowitz, paid $80 million for a majority stake in All Year Management’s 313-331 Bond Street. [TRD]

Landlords will soon have to register the status of their storefronts. The City Council passed the new law last month, as a part of its effort to combat retail vacancies and support small businesses. [TRD]

There’s a new $100 million fund specifically devoted to construction tech. As investment in construction technology is booming, San Francisco-based Brick & Mortar Ventures launched a new fund to target Series A funding rounds. There was about $6.1 billion invested in the sector last year, nearly double that of 2017. [TRD]

One World Trade Center (Credit: Unsplash)

Five years after 1WTC’s opening, the World Trade Center complex is still in the red. Port Authority officials once predicted the site would produce a “peace dividend” that would help fund the agency’s infrastructure other projects, but while One World Trade Center itself is profitable, expenses continued to surpass revenue for the campus as a whole, which includes a park, a transportation hub, and car checkpoints. The largest single expense is security, projected at $91.4 million in the Port Authority’s 2019 budget. [WSJ]

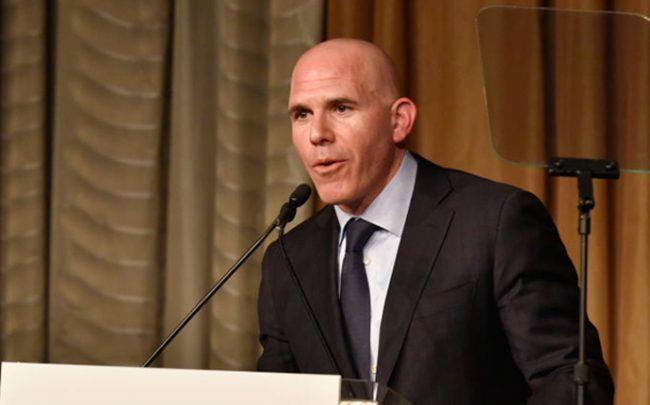

RXR CEO Scott Rechler (Credit: Getty Images)

Activists want RXR to evict ICE from Starrett-Lehigh. A group known as “Evict ICE NYC” launched a flyering campaign outside the building by the Hudson River on Monday, to demand that the general ICE field office on the seventh floor be evicted. RXR head Scott Rechler has previously called ICE policies under the Trump administration “disturbing and inhumane,” but the firm says it has no legal standing to evict the agency. Federal immigration officers first moved to the building after 9/11, two years before ICE was founded. [Gothamist]

Thousands of Lower Manhattan renters may be owed back rent. A recent appellate court decision in favor of residents at two Lower Manhattan 421-g buildings could have wide-reaching implications in the neighborhood, with as many as 6,000 tenants eligible for stabilized leases and owed six years’ worth of back rent. The 421-g tax benefit, active from 1995 to 2006, encouraged conversion of office buildings into apartments and helped double Lower Manhattan’s population during that period. [The City]

A German real estate fund is suing Ashkenazy over the Marriott East Side hotel. Frankfurt-based Deka Immobilien Investment GmbH and minority partner Ashkenazy Acquisition picked up the 655-key hotel for $270 million in 2015, but have struggled with it ever since. In a lawsuit filed Monday, Deka claims that Ashkenazy backed out of a deal to buy the hotel for $174 million — a 35 percent loss — after financing fell through. Deka is now seeking Ashkenazy’s $2 million deposit and reimbursement for legal fees. A source involved in the situation, however, said Deka terminated the deal before the closing date, and that Ashkenazy’s financing remained in place. [Crain’s]

A new bill could legalize hostels in New York City. Affordable lodgings in New York took a hit in 2010 as a result of a state law targeting illegal hotels and Airbnb rentals. The new bill, sponsored by Councilmembers Mark Gjonaj and Margaret Chin, would create a separate classification for hostels and an office within the Department of Consumer Affairs to regulate their licensing and safety. Proponents say the bill will provide more affordable options for tourists and help the city in its fight against Airbnb. A similar bill was introduced in 2015 but did not make it to a vote. [WSJ]

Luxury student housing is pushing low-income students away from campus. An analysis by Bloomberg of census data near UT Austin and the University of Michigan found a correlation between luxury student housing development and rising rents. Students from lower-income families are increasingly finding housing as far as an hour away from campus, resulting in a disconnect from campus life. [Bloomberg]

Compiled by Kevin Sun.