Trending

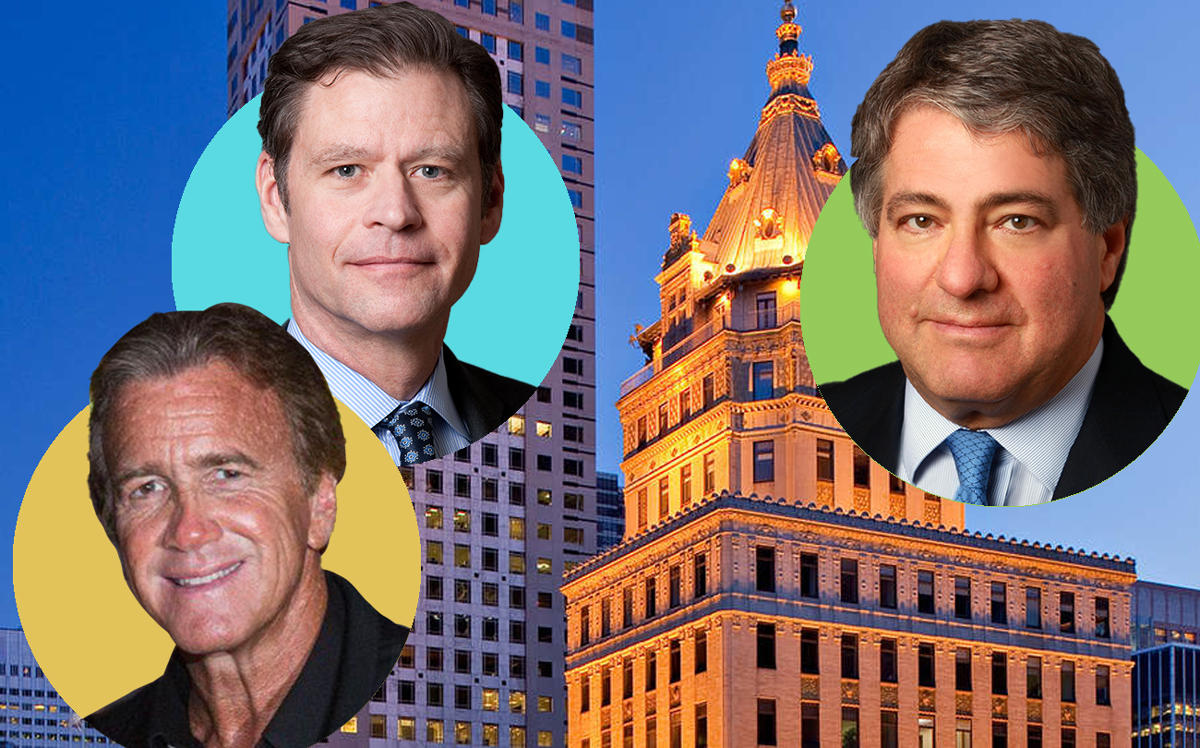

Apollo to provide $800M loan for Crown Building

Wharton Properties and Brookfield closed on the loan with Apollo Global Management on Monday.

The owners of the Crown Building’s commercial portion have secured an $800 million loan to refinance the property, The Real Deal has learned.

Jeff Sutton’s Wharton Properties and Brookfield Asset Management closed on the loan Monday, according to people involved in the deal. Apollo Global Management will provide the $807.5 million loan at between 3- and 3.5 percent interest.

Last month, TRD reported that Apollo and French lender Natixis had signed a term sheet with the landlord, but Natixis walked from deal soon after, sources said. Apollo will now provide the loan without syndication.

The new loan will refinance $720 million in debt backing the commercial portion of the property.

In 2015, Wharton joined with General Growth Properties to acquire the 390,000-square-foot building for $1.8 billion from Eliot Spitzer’s Spitzer Enterprises, a transaction that was in part financed by a $1.3 billion loan from a Deutsche Bank-led syndicate.

After that sale closed, the Wharton and GGP sold the upper 20 floors for $500 million to developers Michael Shvo and Vladislav Doronin. GGP was later acquired by Brookfield, which became the de facto part-owner.

Aaron Appel and Keith Kurland, who recently left JLL to launch their own firm, AKS Partners, represented the borrower. They declined to comment. Sutton declined to comment. Representatives for Brookfield, Apollo and Natixis could not be immediately reached for comment. Sutton could not immediately be reached for comment.

It is the second major deal between Brookfield and Apollo in the past year. In November, Apollo provided Brookfield with a $300 million mezzanine loan for 666 Fifth Avenue, the Midtown tower Brookfield leases from Kushner Companies. That loan was part of a $1 billion financing package backed by Citi Group and ING.