Every day, The Real Deal rounds up New York’s biggest real estate news. We update this page in real time, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 11:30 a.m.

Video produced by Sabrina He

Silverstein signs law firm for 100,000 square feet at 3 WTC. Kelley Drye & Warren signed a 15-year lease at the downtown tower, and will occupy floors 66 through 68. Asking rent in the building hover above $80 a square foot. [CO]

After backlash, WeWork added a woman to its board. The office-space provider’s parent company, the We Company, is adding Frances Frei to its board ahead of its public offering. Frei is a professor of technology and operations management at Harvard Business School, and has consulted the We Company since March of this year. The company faced public scrutiny for revealing an all-male board in its S-1 filing with the U.S. Securities and Exchange Commission. [Reuters]

Larry Silverstein and Brookfield’s Bruce Flatt

Silverstein Properties and Brookfield Properties are in talks to co-develop 5 WTC. The two firms will go against other real estate firms — including Durst Organization, Tishman Speyer and Vornado Realty Trust — in bids for the last remaining World Trade Center lot, which can accommodate 1.3 million square feet of development. The city’s Economic Development Corporation requires proposals by Sept. 20. [CO]

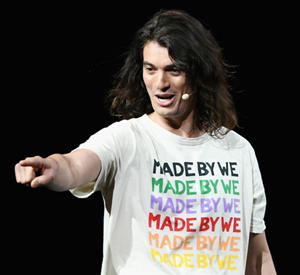

WeWork CEO Adam Neumann (Credit: Getty Images)

WeWork’s IPO roadshow could start next week. The office-space company is aiming to sell about $3.5 billion in shares in the much-hyped event, and already has secured a commitment from major banks for a $6 billion credit facility. [Bloomberg]

Foreign investors are fleeing the U.S. For the first time since 2013, overseas investors sold $13.4 billion in commercial real estate — more than they acquired last quarter. The trend comes as the U.S. bull market matures and uncertain geopolitics have diminished confidence in the local market. [WSJ]

Contactually clients feel abandoned after Compass acquisition. The startup, which provides a customer relationship management tool, has recently told existing clients that it has limited ability to support them, as the majority of its resources have been diverted to building technology for Compass. [Inman]

Rikers Island closure got another green light. New York City’s planning commission voted to approve a plan to build four new jails across the city, a key requirement to shuttering Rikers Island. The project is expected to cost $9 billion. [WSJ]

Law firm Davis & Gilbert is moving to 1675 Broadway. The firm signed an 86,000-square-foot lease at the Rudin Management-owned building, where it will occupy floors 31 through 35. Asking rents in the building are between $64 and $78 per square foot. [NYP]

FROM THE CITY’S RECORDS:

Commercial sales:

A commercial property at 3860 Nostrand Avenue in Sheepshead Bay, Brooklyn sold for $27.65 million. [ACRIS]

Compiled by Mary Diduch

Compiled by David Jeans