One of Long Island City’s most active warehouse buyers has teed up Queens’ biggest deal in nearly a year.

Andrew Chung’s Innovo Property Group has come to an agreement to buy out his partner at the large New York City Housing Authority building in Hunters Point in a deal that values the hulking property at $430 million, sources told The Real Deal.

Westbrook Partners’ Paul Kazilonis (Credit: Mesa West Capital)

Chung and his financial backer, Hong Kong’s Nan Fung Group, are in contract to buy Westbrook Partners’ roughly 90 percent stake in the seven-story, 800,000-square-foot warehouse at 24-02 49th Avenue, sources familiar with the deal told TRD.

Representatives for Innovo and Westbrook couldn’t be immediately reached for comment.

Innovo is currently in talks with lenders to finance the acquisition, which is set to close in the next 30 to 45 days, with a loan north of 60 percent of the property’s value, or more than roughly $260 million.

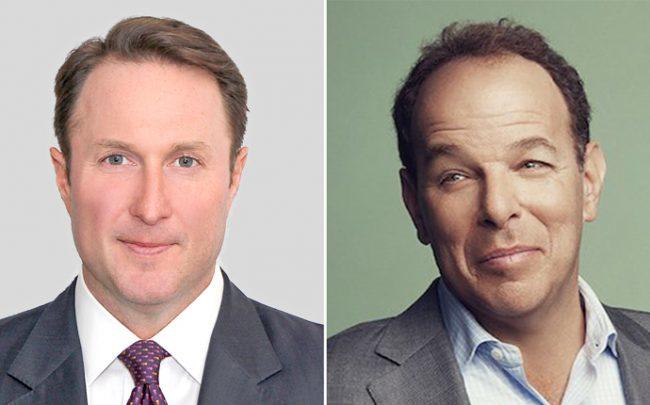

Adam Spies and Doug Harmon

A Cushman & Wakefield team of Adam Spies, Doug Harmon, Josh King and Adam Doneger marketed the property for Westbrook, according to an investor who got a look at the deal. The brokers couldn’t be reached for comment.

If the deal closes, it will be the largest sale in Queens since Blackstone Group paid $475 million to buy the 1,300-unit Parker Towers apartment complex in Forest Hills in November.

Chung, a former executive at the Carlyle Group who founded his investment and development firm in 2015, has been one of the most active buyers of warehouse properties in the city over the past few years, particularly in Long Island City and further throughout Queens.

Last year, Innovo paid $39 million to buy a roughly 150,000-square-foot warehouse in Maspeth at 58-30 Grand Avenue. And earlier this year the firm bought the former FreshDirect warehouse at 23-30 Borden Avenue in Long Island City for $75 million.

Innovo and Nan Fung, one of Hong Kong’s largest private developers, came together in 2016 to form a joint-venture targeting warehouses and last-mile logistics properties. The partners teamed up with Westbrook in 2016 to buy the NYCHA-occupied warehouse for $195 million from investors Rubin Schron’s Cammeby’s International and the Fruchthandler family.

The city’s public housing authority leases about 600,000 square feet in the building. The agency had a lease expiring in a few years, but as part of Innovo’s purchase, Chung’s firm negotiated a 30-year extension to the agency’s lease.

Innovo and Nan Fung plan to convert the building’s top two floors to space for life-science tenants, which investors are betting will be drawn to Long Island City thanks to its favorable zoning and building stock, as well as its proximity to Midtown.

The deal is a boon for Long Island City, which suffered a major blow when Amazon backed out of plans to build part of its second headquarters in the neighborhood earlier this year.

One of the buildings Amazon had eyed for office space, the Citigroup Building at One Court Square, is now looking for new investors. Savanna is looking to recapitalize the 1.4 million-square-foot tower, where it leased about 500,000 square feet to St. Louis-based health care company Centene Corporation after Amazon backed out. Savanna also inked the cable firm Altice USA to a little more than 100,000 square feet to in June.

The same Cushman team that negotiated Westbrook’s sale is taking bids for a 49 percent stake in One Court Square at a valuation of $1 billion.

Correction: A previous version of this article gave an incorrect address for Innovo Property Group’s Long Island City property.