Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page in real time, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com.

Video produced by Sabrina He

Anbang has finally agreed to sell its luxury hotel portfolio… after dealing with some deed fraud. The Chinese insurer was close to a deal with South Korea’s Mirae Asset Global Investments last month, but there was a catch: An unidentified individual in California had created fake deeds to transfer ownership of several of the hotels. Now that that’s been cleared up, Anbang will be selling the hotels to Mirae for more than $5.8 billion. [WSJ]

More office landlords are trying to beat WeWork at its own game. Hines Interests is one of the latest landlords to try their hand at co-working, partnering with WeWork competitors Industrious and Convene to launch “Hines Squared” this June. Firms like Boston Properties and Tishman Speyer have taken a similar approach, presenting yet another challenge to the We Company as it prepares for an IPO. [WSJ]

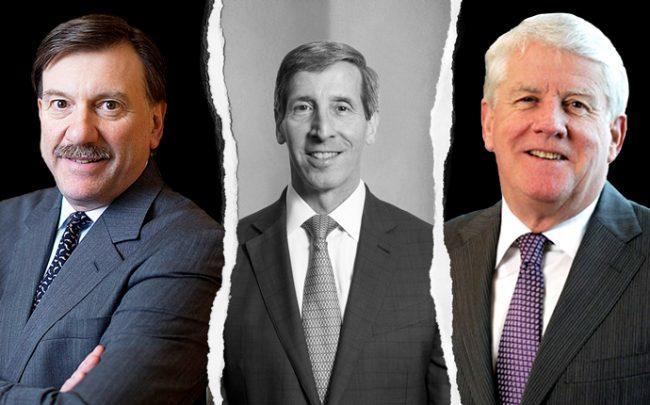

From left: Stewart’s Frederick Eppinger, FTC’s Joseph Simons and Fidelity’s Raymond Quirk (Credit: Getty Images and iStock)

A massive title insurance merger has been called off. Fidelity National Financial and Stewart Information Services announced Tuesday that their proposed merger has been called off, after the Federal Trade Commission did not provide the necessary approval. Fidelity will pay Stewart a $50 million reverse termination fee as a result. [TRD]

Vornado president Michael Franco and 512 West 22nd Street (Credit: VNO)

Vornado Realty Trust’s speculative High Line office development now has an anchor tenant. WarnerMedia has signed a roughly 20,000 square feet for its Innovation Lab at the 11-story office building at 512 West 22nd Street. The media giant will use the West Chelsea office as a technology incubator with a space to showcase products to consumers. [TRD]

Yet another NYC developer is planning a new Israeli bond series. On the heels of Silverstein Properties and Spencer Equities, Lightstone Group has also announced plans for a new issuance worth up to $73 million. Industry insiders say market conditions in Tel Aviv are favoring U.S. issuers once again, following last year’s meltdown. [TRD]

The SEC has reached a settlement with co-working Ponzi scammer Renwick Haddow. According to court documents filed on Monday, the U.S. Securities and Exchange Commission is seeking the New York Southern District Court’s approval of a consent judgment in a civil case against Haddow. The U.K. national, whose company combined bars and office desks in its co-working spaces, was extradited to the U.S. from Morocco last year. [Financefeeds]

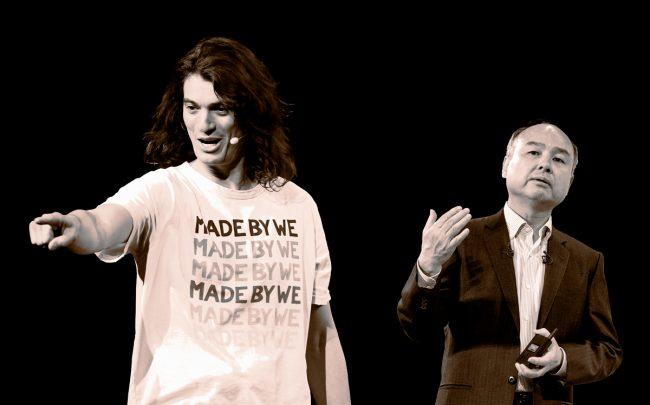

WeWork CEO Adam Neumann and Softbank CEO Masayoshi Son (Credit: Getty Images)

SoftBank wants WeWork’s parent company to hold off on its IPO. The We Company’s largest outside shareholder, which is currently trying to raise $108 billion for its second Vision Fund, may have issues raising funds if the co-working firm IPOs at a big discount — and the company has been considering chopping its valuation by more than half amid scrutiny from investors and analysts. At the same time, holding off on the IPO would cause WeWork to lose access to a $6 billion loan from various banks that is contingent on the success of the public offering. [FT]

More resi firms are getting into mortgages and title insurance. Instant-homebuying company Opendoor became the latest example of this trend in recent weeks, after both acquiring a title and escrow company and launching a mortgage-lending business. Redfin and Zillow have operated such side businesses for years, both as an extra revenue source and a solution to homebuying’s “last mile” problem. [WSJ]

Why did a Manhattan landlord ask for this Far West Side census tract to be an Opportunity Zone? According to documents obtained by TRD, Stellar Management, a firm facing multiple accusations of illegally deregulating New York apartments, included census tract 135 in a list of areas it wanted to be designated as Opportunity Zones. The tract is already highly gentrified, and Stellar’s interest in the area remains unclear. [TRD]

3 WTC’s retail space is still vacant more than a year after opening. Mall operator Westfield (now part of Unibail-Rodamco-Westfield) blames the Port Authority for not handing over the space, and a number of restaurant leases have fallen through as tenants have become tired of waiting. Other challenges Westfield is facing at the mall include a leaking Oculus skylight — which will be closed to the sun for the annual 9/11 observance — and a lawsuit from Duane Reade for failure to deliver a space. [NYP]

The hotel industry’s decade-long rally may be nearing an end. Hotel revenue growth per available room has fallen below 2 percent for two straight quarters for the first time since 2010, as owners struggle with weaker demand, booming supply and rising costs. Hotel REITs have been the second-worst performing category of REITs this year, with only mall REITs doing worse. [WSJ]

The World’s Fair towers in Flushing Meadows-Corona Park are finally getting restored. With more than $24 million in funding available, the restoration of the New York State Pavilion’s observation towers is finally set to kick off this month. Originally built as temporary structures for the 1964 World’s Fair, the towers were later deemed “too expensive to tear down” and have been deteriorating for decades. [Curbed]

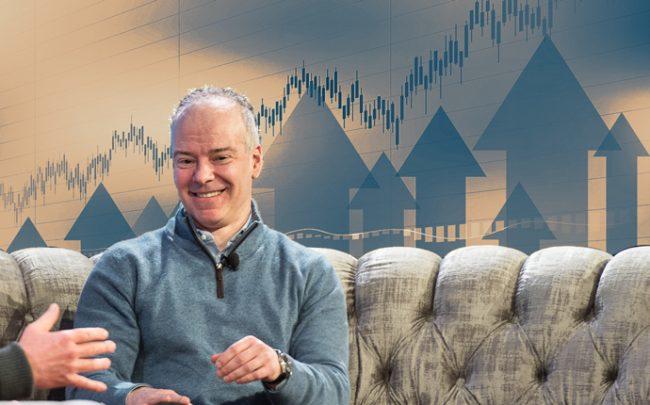

Realogy CEO Ryan Schneider (Credit: iStock)

Realogy’s stock price jumped more than 11 percent on Monday. The uptick comes after a weekend of intrigue, rumor and conflicting statements surrounding the brokerage’s legal battle with Compass. Last week, Compass claimed Realogy CEO Ryan Schneider once attempted to sell the firm to Compass — a claim that Realogy has denied. [TRD]

Marquee Brands is moving to Vornado Realty Trust’s 330 West 34th Street. The company that manages names like Martha Stewart and Bruno Magli has signed a new 27,811-square-foot lease at the property, where asking rent was $90 per square foot. Marquee’s offices were previously located at RXR Realty’s Starrett-Lehigh Building. [NYP]

The city is getting a second opinion on its Lower East Side flood barrier plan. Manhattan Borough President Gale Brewer and Councilmember Carlina Rivera have tapped a Dutch environmental advisor to review the plan, which saw costs double amid dramatic design changes last year. Locals have been calling for such a review for months. [The City]

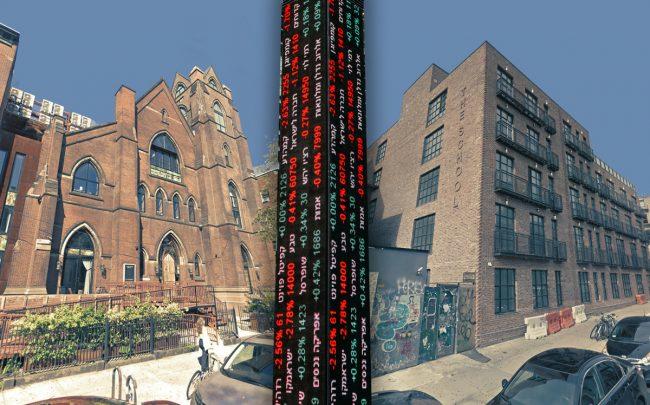

From left: “North Flats Phase 1” (163 North 6th Street) and Phase 2 (180 North 7th Street) (Credit: Google Maps and iStock)

Another NYC developer is eyeing a Tel Aviv Stock Exchange comeback. A week after Silverstein Properties announced plans to issue a new Israeli bond series, Joel Gluck’s Spencer Equity is doing the same. Spencer’s bonds will be secured by a Williamsburg rental project that was previously a church, part of which has been delayed for years due to a zoning violation. [TRD]

FROM THE CITY’S RECORDS:

Commercial sales:

Rabsky closed on a medical facility at 240 Willoughby Street in Fort Greene for $95 million. [ACRIS]

Compiled by Mary Diduch