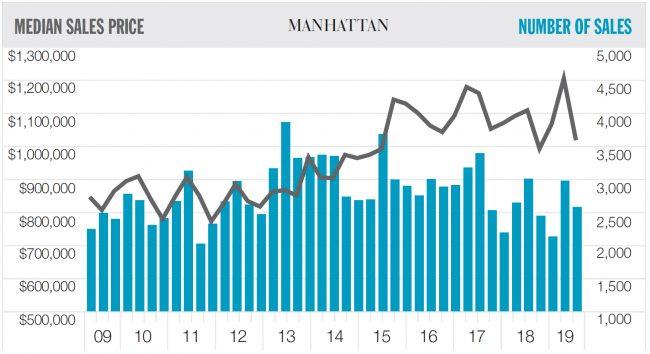

After sales soared last quarter, Manhattan’s residential sales market is crashing back to reality — though low mortgage rates are softening the landing.

The number of closed sales fell by more than 14 percent year over year in the third quarter, and the average sales price dropped to $1.65 million, down from over $2 million last quarter and $1.9 million in 2018, according to Douglas Elliman’s report authored by appraisal firm Miller Samuel.

The swift decline compared to the second quarter’s 12.5 percent year-over-year increase is due to the flurry of closings ahead of the mansion tax’s July implementation, according to Jonathan Miller, president and CEO of Miller Samuel. He said if you compared all three quarters in 2019 to the same period last year, “overall sales are only down 1.9 percent.”

But there’s also an unusual bright spot that’s keeping some smiling: all-time low mortgage rates. As a result, buyers this quarter took out more mortgages than in the past five years, while the number of cash buyers fell steeply, according to Miller.

High and low: Home refinancing spikes as mortgage rates drop below 4%

NYC’s condo market is showing signs of a recession

Since he began tracking the share of cash sales compared to mortgage purchases in 2014, an average of 80 percent of sales over $5 million were cash. But, this quarter, that fell to 44.2 percent. Furthermore, he found that the rise of financing occurred at “all price strata.”

“An unusual amount of people took advantage of this opportunity,” he noted.

For Joseph Palermo at Valley National Bank, however, low mortgage rates are driving an unprecedented level of business among high-net worth clients.

“I’m doing the biggest mortgages I’ve done,” he said. “The more [financially] fluent are taking more leverage.”

He said he recently handled a $10 million interest-only, adjustable-rate mortgage with a 10-year term for a $30 million property in the Hamptons. In Manhattan, he said issuing $5 million, $6 million or $7 million mortgages used to happen once or twice a quarter. But “now they’re monthly.”

Halstead’s Diane Ramirez called financing the “smart thing to do” and said it just adds to buyers’ arsenal.

“It’s almost free money,” she said. “The purchasing power that buyers have today is something I haven’t seen in years.”

Steven James, CEO and president of Elliman called the rise in leveraged buyers “a good sign.”

“The thing to remember is two thirds of the consumers rent and only one third own,” he said. So when rates go down, “you have a huge pool of potential buyers.”

But if new buyers are jumping into the market as a result of the rates, the data is not bearing it out.

Though Miller believes low mortgage rates are behind some of the quarter’s larger transactions, he said, “I think what it did is mask … a portion of the weakness in an already weak market.”

He pointed to falling prices as a sign of hope that sellers are adjusting to market realities. And, despite concerns about the ballooning condo inventory and talk of a coming recession, Miller doesn’t see oversupply as a problem. He compared this quarter’s average market inventory of 7,353 units to the 19-year average of 6,629 units.

“Inventory overall is high but it’s not at record levels,” he said, noting that the quarterly average following the 2008 crash was 10,445 units. He said that, aside from price, the bigger issues holding back buyers are political. Notably, changes to federal, state and city property taxes, the ongoing trade war with China and the state rent laws’ overhaul.

“Uncertainty is the operative word that is behind the real estate market right now,” he said.

Write to Erin Hudson at ekh@therealdeal.com