Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 9 a.m.

Video produced by Sabrina He

Amid bankruptcies and closures, online clothing retailers could benefit from brick and mortar. Though online-only retailers have long traded at a premium as investors expect them to benefit from economies of scale, some analysts argue that the complexities of warehouse management actually make it harder for them to process orders efficiently — especially given the high return rates that most online stores experience. Traditional storefronts could offer a solution to those logistical challenges. [WSJ]

Toys “R” Us’ relaunched website will be run by… Target. The bankrupt toy retailer’s parent company, TRU Kids, is partnering with Target to relaunch ToysRUs.com ahead of the holiday season. Once shoppers hit “Buy” on the site, they will be redirected to Target.com to complete the transaction. Toys R Us, which filed for bankruptcy in 2017, will also begin opening new stores in U.S. [CNBC]

Brooklyn co-working space New Lab has a second location — but isn’t profitable yet. The startup, whose Brooklyn Navy Yard flagship is home to cutting-edge tech tenants like a 3D-printed rocket engine maker and an artificial leather growing company, told the Wall Street Journal it has plans to boost revenue from alternative sources. [WSJ]

Cushman & Wakefield’s stock price rose 10 percent in September. In addition to overall market optimism as U.S.-China trade negotiations resumed, as well as better-than-expected real estate market indicators, the brokerage appears to have further benefited from positive press: monthly magazine “Euromoney” named Cushman the top overall company for property valuation and research, as well as the top real estate adviser in many individual markets. [Motley Fool]

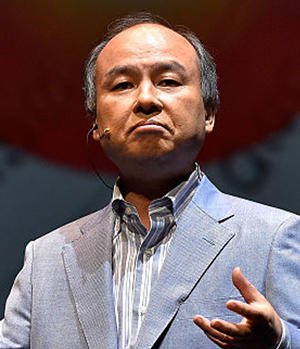

Masayoshi Son (Credit: Getty Images)

Masayoshi Son is “embarrassed and impatient” with the Vision Fund’s losses. As analysts foresee billions in losses from WeWork’s scrapped IPO and Uber’s collapsing stock price, the SoftBank boss told Japan’s Nikkei Business magazine that the fund’s results have fallen well short of his goals. Despite current struggles, Son said that he expects his investments in WeWork and Uber to be profitable in a decade or so. [Bloomberg]

Realogy CEO Ryan Schneider

Realogy is retooling its iBuyer program to give owners more “speed and certainty.” A year after first joining the instant-homebuying craze, the brokerage giant is now rolling out RealSure, a revamped version of the platform that will allow sellers to accept a cash offer at any time within 45 days. The service is currently available in Dallas and Denver through a number of Realogy franchises, and will soon launch in markets such as Chicago, Tampa, Houston and Sacramento. [Inman]

WeWork leases in Soho and Flatiron could be in trouble, according to a report (Credit: iStock)

WeWork’s leases in Soho and Flatiron pose the most risk to landlords. According to a report from Ackman Ziff, the struggling co-working company’s lease obligations are only 2 percent below market rate in Soho and 4 percent below in Flatiron, while its average rent in Manhattan overall is 20 below the average. With 6.5 million square feet throughout New York City, WeWork accounts for 56 percent of the city’s co-working market. [TRD]

“Immersive” retail chain CAMP is getting a Hudson Yards outpost. The family-friendly “play and product” chain, which opened its first New York location at 110 Fifth Avenue in Flatiron last year, is set to launch a 6,000-square-foot outlet on the mall’s second floor in the coming months. [NYP]

A new City Council bill would require landlords to provide tenants with physical keys. The bill comes amid concerns surrounding keyless technology in apartment buildings in the city, which came to a head in a recent lawsuit settlement between tenants and owners of 521-525 West 45th Street, where smart lock technology from Latch had allegedly locked a tenant out at night. Two other bills pertaining to facial recognition technology in apartments were also introduced on Monday. [TRD]

Some co-living companies are looking to cut costs with fewer amenities and smaller spaces. A new wave of startups is looking for ways to provide affordable housing to low-wage workers in expensive cities, but may run afoul of single-room occupancy regulations as they expand to more markets. “This is the only attainable housing solution for them realistically, at least without subsidy,” said the founder of Atlanta-based PadSplit, whose average tenant makes about $20,000 a year. [WSJ]

A six-story Meatpacking District building which was asking $75 million last year is back on the market. The 26,343-square-foot building at 799 Washington Street was previously marketed by Sotheby’s International Realty as potential mega-mansion among other uses, thanks to the flexible zoning. The property is now being marketed by JLL. [CO]

Blackstone sold a 100-building industrial portfolio to Nuveen for $3 billion. The 29 million-square-foot portfolio spans the country from Southern California to Northern New Jersey, and was part of the massive $18.7 billion logistics portfolio that Blackstone bought from Singapore’s GLP earlier this year. [TRD]

FROM THE CITY’S RECORDS:

New Permit Filings: Yisroel Greenfeld filed plans for a seven-story, mixed-use development at 1884 Broadway in Ocean Hill, Brooklyn. [DOB]