L+M Development Partners and Invesco Real Estate have closed on their purchase of Brookfield’s Putnam portfolio thanks to about $823 million in financing from Wells Fargo, according to sources familiar with the deal.

“The purchase of this portfolio of properties will help preserve the affordability of hundreds of rental units in New York City,” Wells Fargo’s head of government-sponsored enterprise Mark Beisler said in a statement.

The money is an agency loan with Fannie Mae and covers four of the five properties that L+M and Invesco are buying.

Doug Harmon, Adam Spies, Josh King and Adam Doneger of Cushman & Wakefield brokered the sale. Cushman’s Gideon Gil arranged the debt.

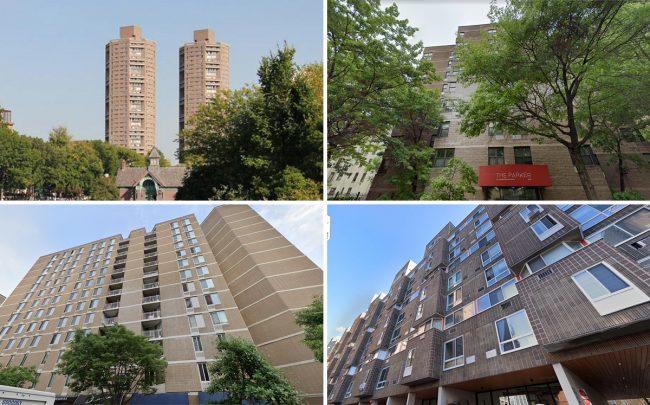

Clockwise from top left: 1295 Fifth Avenue in East Harlem, 1890 Lexington Avenue in East Harlem, 1940 First Avenue on the Upper East Side and 552 Main Street on Roosevelt Island (Credit: Google Maps)

Invesco and L&M purchased the portfolio from Brookfield, a global asset manager that had put it up for sale in March. It has about 4,000 units across six Manhattan properties: 3333 Broadway near Columbia University, 1295 Fifth Avenue in East Harlem, 1990 and 1890 Lexington Avenue in East Harlem, 1940 First Avenue on the Upper East Side and 552 Main Street on Roosevelt Island.

Urban American joined with investors to buy the portfolio in 2007 for $938 million and sold a majority stake to Brookfield in 2014 for $1.04 billion. L&M and Invesco partnered to buy a 2,800-unit portion of the portfolio in July for $1.2 billion, consisting of every building except the one at 3333 Broadway. The financing package covers all of the properties except the Roosevelt Island one.

Brookfield and L+M declined to comment on the sale. Invesco did not immediately respond to a request for comment.

Rich Bockmann contributed reporting.