Another quarter, another Vornado retail tenant bankruptcy.

After facing the abrupt closure of two Topshop stores in New York City in the second quarter, Vornado Realty Trust encountered more retail challenges in the third quarter as Forever 21 filed for Chapter 11 bankruptcy protection. But Forever 21 may be able to keep its stores at 435 Seventh Avenue and 1540 Broadway open for a bit longer.

435 Seventh Avenue (Credit: Vornado)

“While the bankruptcy process is fluid and is still in its early stages, we have reached a tenant agreement with Forever 21 to shorten their leases and retain them in those two locations for a little less than half of their current rent,” Vornado president Michael Franco said on the firm’s third-quarter earnings call Tuesday. The landlord will have the right to “recapture the spaces at any time after the first year, enabling us to secure long-term tenants for these spaces.”

Read more about Vornado

A third Forever 21 lease, at 4 Union Square South, is set to expire next month, and part of the space has already been released to Whole Foods for its expansion. The annual rent at the two remaining locations totals approximately $20 million, Franco said.

The real estate investment trust reported adjusted earnings of $52.6 million or $0.28 per share for the third quarter, down from $0.34 per share for the same period the year before.

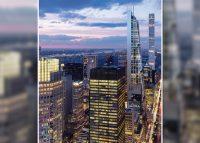

1540 Broadway (Credit: Getty Images)

“Obviously it was a negative surprise, in the sense that we had term on the lease, and all of sudden they filed and we had to deal with a real-time situation,” Franco said during the Q&A portion. “The deal that we struck works for both parties, and importantly keeps the space occupied and paying rent, and allows us the flexibility to go trawl for tenants that will occupy the space long-term.”

Franco noted that 1540 Broadway is “arguably the best location in the city right now” with a blockfront on one side of the Times Square bowtie. The property is part of the retail joint venture Vornado formed in April with Crown Acquisitions and Qatar Investment Authority.

Meanwhile, he said, the five-year lease at 435 Seventh Avenue “was always a short-term deal” meant to give the company time to prepare a redevelopment of the entire block, which is on the edge of Vornado’s Penn Plaza development area.

The Forever 21 rent cut, together with other factors such as the temporary closing of the Long Island Rail Road retail concourse at Penn Station and reduced revenue expectations for the Hotel Pennsylvania, have put a damper on Vornado’s immediate financial future.

“We no longer believe that 2020 will be a substantial bounce-back year. It’s going to have to wait a little longer,” Vornado CFO Joseph Macnow said.

But Franco emphasized that the long-term outlook is very positive.

“Our big growth engine is the Penn District. We have tremendous confidence in what we are doing there, and the early reception has been very positive,” he said. “It’s going to require a little patience, but the growth is going to come quite meaningfully.”

Forever 21 at 4 Union Square South (Credit: Getty Images)

Though Vornado executives did not name specific companies, major tech tenants such as Apple and Facebook have reportedly shown interest in leasing space at the massive James A. Farley Post Office redevelopment. Franco also noted that the firm is negotiating a lease with a “400,000-square-foot headquarters tenant” at nearby Penn 2.

Vornado is also planning to offer flex and co-working space to tenants at Penn 1 and Penn 2, under the company’s own name, retaining the bulk of the upside. Glen Weiss, Vornado’s executive vice president of office leasing, noted that this would be particularly beneficial at a large building like Penn 1, with more than 200 tenants occupying 2.5 million square feet.

“We’re always seeing tenants needing agile space, whether it’s swing space, expansion space, or short-term Band-Aid space for whatever reason, so we think at Penn doing co-working and flex space is going to be a huge benefit to us and our tenants,” Weiss said.

While emphasizing that Vornado’s exposure to WeWork as a tenant was limited to a mere 15,000 square feet at 606 Broadway, Franco said that WeWork’s recent struggles had little to do with the company’s decision to provide co-working services in-house.

“We want to control exactly what goes on here, curate exactly how we want it, create the right vibe,” he said. “We don’t think there’s anyone better to do that than ourselves.”

“And by the way,” he added, “that’s always been the plan.”