Every weekday, The Real Deal rounds up New York’s biggest real estate news. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4:53 p.m.

It’s no secret that the Manhattan condo market could be better. But an analysis of contract data reveals that condo sales are even worse than conventional measures suggest. The data show that sales for the first three months of 2019 are only a third of what they were in 2015. [WSJ]

Good news for fast fashion fans. Sixty stores previously slated for closure in Forever 21’s bankruptcy proceedings will stay open. Forever 21’s landlords have been “flexible about cutting deals,” according to one analyst. [Business of Fashion]

WeWork is rethinking its London expansion plan after a bailout from its major investor, SoftBank. Twenty-eight potential office deals hang in the balance in London, WeWork’s second largest market. The company accounts for 7 percent of central London leasing, according to data from Costar. [Bloomberg]

Donald Trump (Credit: Getty Images)

Trump says goodbye to New York. The president, a lifelong New Yorker, is changing his official address to his Mar-A-Lago residence in Palm Beach, Florida. He said that city and state leaders have treated him poorly. “Few have been treated worse,” he tweeted.

[NYT]

….New York, and always will, but unfortunately, despite the fact that I pay millions of dollars in city, state and local taxes each year, I have been treated very badly by the political leaders of both the city and state. Few have been treated worse. I hated having to make….

— Donald J. Trump (@realDonaldTrump) November 1, 2019

Marriott has parted ways with the St. Regis hotel. The Qatar Investment Authority paid $310 million for the iconic Fifth Avenue property. Another entity from Qatar bought New York’s Plaza hotel last year for $600 million. QIA has partnered with Brookfield, provided debt for JDS Development and Property Markets Group’s 111 West 57th Street condo tower, and participated in a Compass’ funding round. [WSJ]

Compass and Opendoor’s CEOs are sitting out a Saudi tech conference this month. A spokesperson for Compass said Robert Reffkin wasn’t invited. Meanwhile, OpenDoor CEO Eric Wu turned down his invitation. Last year, SoftBank CEO Masayoshi Son and JPMorgan Chase CEO Jamie Simon were among dozens of leaders who pulled out of the “Davos in the desert” conference, after the death of journalist Jamal Khashoggi. [Inman]

The Woolworth penthouse got a $31 million price chop. Alchemy Properties is hoping that will entice a buyer for the five-story aerie, which has been marketed at $110 million since 2017. The firm has also hired David Hotson, an architect who specializes in unusual spaces, to design the unit. [WSJ]

Jumaane Williams and Joseph Borelli (Credit: Getty Images, Joseph Borelli)

Real estate donors aren’t contributing to the public advocate candidates. Unlike the February race, which included Michael Blake and Melissa Mark-Viverito, the November contest between Jumaane Williams and Republican City Council member Joseph Borelli has seen little industry cash. [TRD]

Don’t count JC Penney out. The cash-strapped retailer is testing a plan to expand amenities and offer yoga classes in a Texas store before rolling the strategy out to its 850 stores nationwide. [WSJ]

Another condo at Vornado’s 220 CPS sold for $61 million to an anonymous buyer. The sale of the unit on the 47th floor comes just after another unit sold for $55 million two floors below. [TRD]

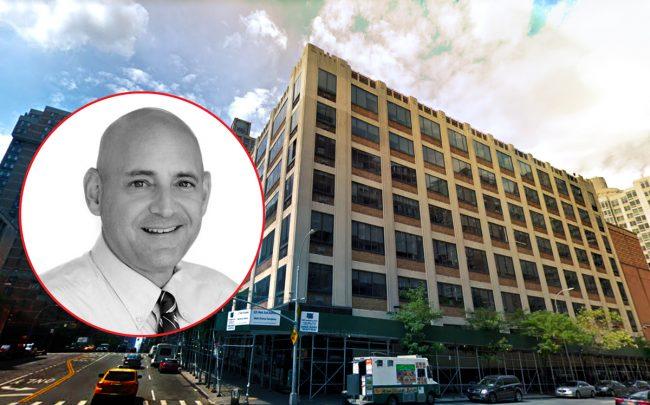

LoanCore Capital’s Mark Finerman and 125 West End Ave (Credit: Google Maps)

Taconic Investment Partners and Nuveen lined up a $181 million loan to fund their West End Campus buy. LoanCore Capital, a Washington D.C.-based real estate investment trust, provided the debt for the $238 million acquisition. The three properties are a small portion of a portfolio Silverstein bought last year from ABC for $1.2 billion. The deal closed Wednesday. [TRD]