After a late-2018 shakeup saw Israeli investors rethink their interest in U.S. real estate bonds, one new entrant to the market is already coming back for more.

Dallas-based Westdale Asset Management, which debuted on the Tel Aviv Stock Exchange with a 500 million–shekel (about $140 million) Series A bond issuance in April, is now looking to raise another 180 million shekels (roughly $52 million) for its Series B, according to rating documents filed with the exchange Tuesday.

Read more We Work story

The upcoming bond series has received a rating of ilA+ from Maalot, a subsidiary of S&P Global. That’s one notch lower than the ilAA- rating of Westdale’s Series A bonds, mainly because the Series B bonds will be unsecured corporate bonds.

Westdale’s first bond series was secured by three Texas properties, including the office portion of the company’s flagship development, the 8-acre Epic complex in downtown Dallas. The majority of bonds issued in Tel Aviv are unsecured, but issuers such as Brooklyn’s Spencer Equity and All Year Management have been known to provide secured bonds as a way to boost investor confidence.

Westdale’s Series B bonds will be more like normal Tel Aviv bonds in another respect as well: They will be issued via a Dutch auction on the coupon rate. The developer issued its Series A bonds through a less common “book building” deal, in which the underwriter committed to hold some of the bonds and could choose which investors to include.

A representative for Westdale did not respond to a request for comment.

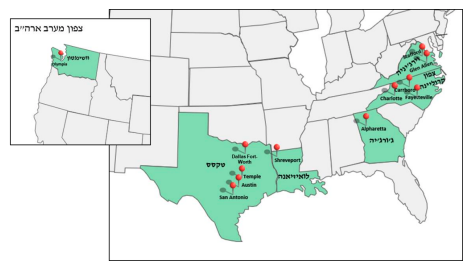

The firm, whose properties are mainly located in the southern United States, has had a great first half year in Tel Aviv. After opening at slightly above par value in April, Westdale’s Series A bonds have risen steadily and are now trading at more than 108 cents on the dollar.

Locations of properties in Westdale’s bond-issuing entity portfolio, from a Tel Aviv Stock Exchange prospectus.

Westdale’s recent success with Israeli investors came on the heels of months of upheaval in the Tel Aviv bond market, which started with concerning disclosures from a few U.S. firms and developed into a market-wide crisis of confidence.

In August, Westdale announced that it had secured rideshare company Uber as the anchor tenant for its second planned office tower at the Epic complex with a 450,000-square-foot lease. Uber will occupy the recently completed first tower in the meantime.

Elsewhere in the country, the real estate investment trust is also seeking to develop a mixed-used development in the Wynwood neighborhood of Miami.