Every weekday The Real Deal rounds up New York’s biggest real estate happenings. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com.

This page was last updated at 9 a.m.

The WeWork layoffs could happen as soon as this week. The co-working company could let go at least 4,000 employees, although this number may end up being as high as 5,000 or 6,000. Its core office space subletting business would let go 2,000 to 2,500 employees, while 1,000 more would leave as the company sells or shuts down its non-core businesses. [NYT]

WeWork is reportedly facing an SEC probe

WeWork is also dealing with a reported SEC investigation. The inquiry is said to focus on whether the company broke reporting rules — particularly when it came to potential conflicts of interest — ahead of its IPO. [TRD]

The real estate industry and Mayor Bill de Blasio are aligned on this big issue: Both skeptical of a City Council plan to regulate commercial rents. The bill from Council member Stephen Levin would create a Commercial Rent Guidelines Board that would regulate rents on certain small retail, manufacturing and office spaces. However, de Blasio has already expressed skepticism about the idea, saying at a Thursday press conference, “Every time that I’ve been in a conversation over [the] years, on commercial rent control, I can’t find a legal way to do it.” [Gothamist]

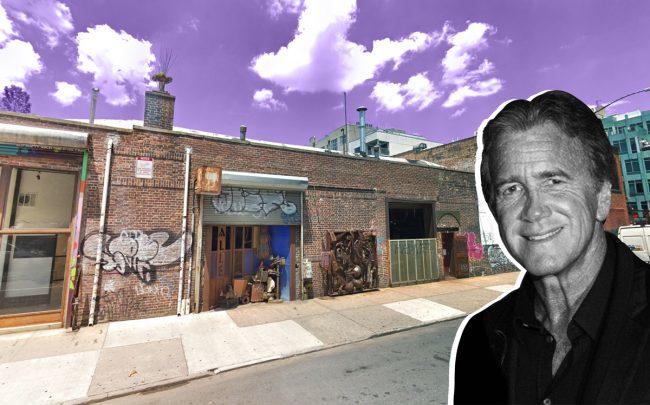

166 Berry Street in Brooklyn and Wharton Properties’ Jeff Sutton (Credit: Google Maps)

A Williamsburg building sold for a record price. Wharton Properties bought 166 Berry Street for $20 million, which works out to $3,226 per square foot. The seller’s brokers say this is a record for the neighborhood. [TRD]

Knotel will likely slow down its growth. Co-founder Edward Shenderovich said at a panel on Tuesday that the company has grown almost fourfold over the past year, and “given what happened with WeWork, we will probably slow down.” Knotel’s portfolio in New York City spans 2.5 million square feet, which includes 780,000 square feet of space that is currently or soon to be vacant. [Crain’s]

Manhattan saw 21 luxury contracts signed for about $158 million last week. Both figures were up from the previous week, when 20 contracts were signed for about $134 million. The properties spent an average of 656 days on the market and had an average discount of 6 percent from the original asking price. [Olshan]

Brooklyn’s luxury market saw 19 contracts signed for about $61.3 million last week. Both numbers were up from the previous week, when 14 contracts were signed for about $45.4 million. The properties spent an average of 151 days on the market and had an average discount of 5 percent. [Compass]

Masayoshi Son told Adam Neumann he reminded him of Jack Ma. Ma had turned SoftBank’s $20 million investment in Alibaba into a $200 million company. Son had high hopes he would see similar results with his investment in WeWork. In 2016, Son was also almost two hours late for a tour of WeWork’s Manhattan headquarters and told Neumann he only had 12 minutes when he arrived. [Fast Company]

An affordable housing project for Far Rockaway has passed the City Council. The project is known as Edgemere Commons, and it will bring 2,050 affordable housing units across 11 buildings to the site of the former Peninsula Hospital. It will also include a Western Beef supermarket and community space. [Curbed]

Thor Equities landed a $92 million refinancing in Downtown Brooklyn. The loan for the office and retail property at 180 Livingston Street comes from MetLife. Thor bought the building in 2015 for $136 million. [CO]

A lawsuit accuses the Forge in Long Island City of discriminating against the disabled. The lawsuit from the Fair Housing Justice Center argues that the hallways and main entrance of the building are too narrow for wheelchairs. It also claims that thermostats and outlets are out of reach and door handles are inaccessible. [The City]