Shortly after Facebook snapped up 1.5 million square feet across three Hudson Yards office buildings, the developers are cashing out with a massive new loan on one of the towers.

A joint venture between Mitsui Fudosan America, Related Companies and Oxford Properties secured a $1.245 billion loan from Wells Fargo, Deutsche Bank and Morgan Stanley last week, using the 1.4 million-square-foot 55 Hudson Yards as collateral, according to a rating document published by Kroll Bond Rating Agency on Monday.

The report also reveals previously undisclosed terms of Facebook’s leases at 50 and 55 Hudson Yards, where the social media giant is taking 1.2 million and 57,000 square feet, respectively. (Details of Facebook’s 265,000-square-foot lease at 30 Hudson Yards were not included.)

At 55 Hudson Yards, the tech giant is paying $116 per square foot and has seven months of free rent. Its tenant allowance of $190 per square foot, which represents the amount the landlord is willing to spend on space improvements, is more than double that of any other tenant at the building. Based on the current rent listed in KBRA’s report, that’s roughly $6.6 million in rent annually.

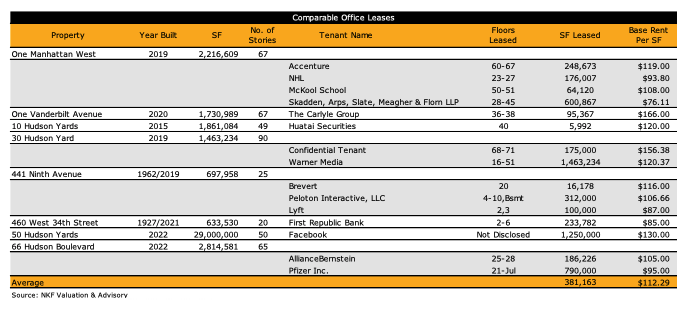

At 50 Hudson Yards, Facebook will be paying a base rent of $130 per square foot, a rather high number in comparison with other major new development office leases. That’s $156 million in rent annually. (Information on 50 Hudson Yards and other properties was obtained from Newmark Knight Frank Valuation & Advisory, the report notes.)

(Credit: Kroll rating report)

The 51-story office building at 55 Hudson Yards, developed at a cost of about $1.3 billion, was previously unencumbered by debt. Loan proceeds will be used, among other things, to “recapitalize the borrowing entity, fund a $48.2 million reserve for outstanding landlord obligations for tenant improvement and leasing commissions,” and “return approximately $1.1 billion of equity to the sponsors,” the Kroll report says.

Despite the lack of prior debt on the building, Kroll notes that the property has payment in lieu of taxes (PILOT) obligations that are secured by three mortgages totalling $501 million, whose liens are senior to the CMBS loan. Public records also show that the property received a $100 million loan from Bank of America in 2013 — before Mitsui paid $258.78 million for a majority stake.

Representatives for Related did not respond to a request for comment. Representatives for Wells Fargo and Morgan Stanley declined to comment.