Agents can circumvent a new law that caps rental application fees at $20.

So says attorney Lisa Faham-Selzer, at least. Others aren’t so sure.

But Faham-Selzer says a dual agency agreement she developed will allow agents and brokerage firms to continue collecting application fees as they did before Albany’s new legislation took effect.

The cap on what real estate agents and owners can charge potential tenants for the processing of rental applications was introduced in June as part of New York’s sweeping rent law. It was not immediately clear to some agents and brokerage firms whether that $20 cap applied to them until September, when the Department of State issued guidance said it does.

<strong>Read more</strong>

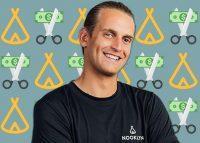

The news had an immediate impact on brokerages’ bank accounts, prompting some firms to alter their business model. Brooklyn-based Nookyn was one of them — and its changes led to a backlash, immediately after which founder and CEO Harley Courts lost his job.

Faham-Selzer, a partner at Midtown-based Kucker Marino Winiarsky & Bittens, said she began looking for a way around the cap because she “really felt” for agents who had to absorb the cost of application fees. Industry sources previously said fees for rental applications are typically $75 to $125.

“To operate at a loss and be operating on commission is insane to me,” the attorney said. Faham-Selzer noted that the dual agency agreement she came up with does not include terms for agents’ commissions should a renter sign a lease.

The attorney has advised her clients, which include agents and brokerages, to offer renters a dual agency agreement that allows an agent to represent them and a landlord simultaneously — and permits them to charge renters a servicing fee greater than $20.

“Renters pay the $20 to broker in their capacity as ‘landlord’s agent,’” she explained, and then pay “an additional processing or service fee” to the agent for acting as their representative.

The attorney said she believes it’s a win-win for renters, who benefit from agent representation, and for agents, who can ensure their costs are covered.

But some brokerage leaders, including Douglas Elliman’s Hal Gavzie and Bold New York’s Jordan Sachs, expressed concern about Faham-Selzer’s strategy.

Sachs said his firm is taking the “cautious approach” and charging $20 for application fees regardless of whether Bold agents represent renters or owners.

“It’s a sensitive time and to be the first one out to go against the broader interpretation of these rules is just not something I would want,” he said.

Gavzie said Elliman is being “as conservative as possible” when it comes to the law, though he admits there’s a “grey area” on how the provision regarding application fees could be interpreted.

Other lawyers such as Starr Associates’ Shaun Pappas say the state’s guidance clearly states that the $20 cap does not apply to licensed agents engaged to represent “the interests” of a potential tenant.

But he noted that means agents using a dual agency agreement must act on behalf of the tenant and “not just fill out the application and collect a higher fee.”

Other lawyers were uncertain.

“It’s a creative way to get around the statue, but that’s what concerns me about it,” said Justin Bonanno, partner at Ganfer Shore Leeds & Zauderer. “Until it gets challenged by a court, nobody’s going to know.”

He added, “You don’t want to be the poster child for having violated this brand new statute.”

Faham-Selzer rejected the idea that dual agency could be seen as violating the spirit of the law.

“It is my belief that had [Department of State officials] chosen to prevent dual agencies from collecting more than $20, they would have specified,” she said. “Dual agents are highly regulated.”

The department has issued strong warnings to consumers about dual agency in the past.

Moses Stark, a Brooklyn-based agent who runs a four-person firm, is one of Faham-Selzer’s clients using the dual agency agreement.

He said that about 80 percent of the time he’s offered the agreement to renters over the past two months, renters sign and hire him as their representative and pay more than $20 to submit their applications.

Stark said the agreement allows his team to offer renters better service.

“I’m trying to get them to come back and use me again,” Stark said. “There’s no way they’re going to come back and use me again if they pay $20. You’re not going to buy coffee again at a place where they charge a quarter.”

Write to Erin Hudson at ekh@therealdeal.com