Since the market meltdown in Tel Aviv, Yoel Goldman’s All Year Management has spent all year managing the worries of bondholders. But the developer’s latest earnings report has investors on edge again.

All Years’ British Virgin Islands–registered bond-issuing entity suffered a stunning $40.8 million loss in the third quarter, an earnings report released on Thanksgiving revealed. That brought the company’s total losses for the year to $52.4 million — a dramatic reversal from its $76.9 million profit in the first three quarters of 2018.

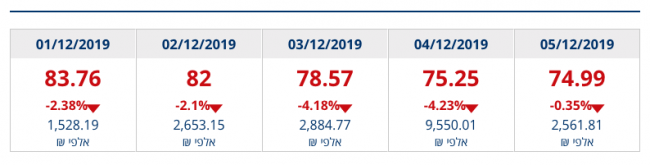

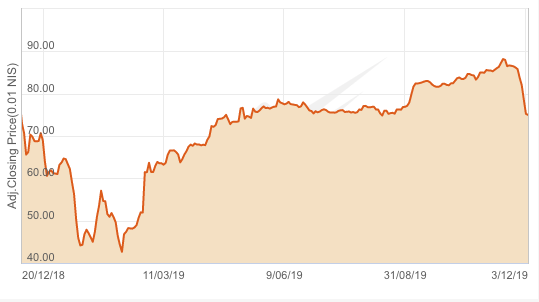

Bondholders responded negatively to the disclosure, and the value of all four of Goldman’s active bond series dropped significantly over the past week. The firm’s two unsecured corporate bond series fared particularly poorly, with Series B bonds falling 12 percent to 74.99 cents on the dollar as of yesterday’s close, while the Series D fell 15 percent to 63.24 cents on the dollar.

The Series C and E bonds, secured by first mortgages on All Year’s New York properties, dipped by six percent and four percent, respectively.

Representatives for All Year did not respond to a request for comment.

According to the earnings report, the massive loss was primarily driven by two factors: a $10 million loss from “changes in the value of real estate for investment” (where the firm saw a $10 million profit in the same quarter a year before), and $48.3 million in financing costs — bringing the firm’s total financing costs to $101.4 million for the first three quarters in 2019, far higher than last year’s nine-month total of $25.7 million.

An article published on Israeli news site Bizportal Wednesday has raised additional concerns about All Year’s accounting, noting that the firm’s EBITDA-to-debt ratio has long hovered around 18.6 percent to 18.8 percent — just below the 19 percent threshold that would entitle Series B bondholders to demand immediate payment of the bonds.

“All Year is a loss-making company with unimpressive cash flows, and it is held up with massive debts,” author Eran Sokol wrote in the article, adding that the company has no means of paying off those bonds immediately.

Despite the one-week slide, All Year’s bonds are still trading significantly higher than they were in the depths of the market panic earlier this year, when the Series B and D bonds fell to as low as 42.6 cents and 38.1 cents on the dollar, respectively.

That panic, first triggered by All Year’s disclosure of what it called an accidental transfer of $3.7 million to Goldman’s personal account, combined with the struggles of other U.S. issuers such as Brookland to set off a market-wide rout.

Since then, most of the affected firms — including All Year — have seen their bond prices recover considerably, and major firms such as Silverstein Properties and Lightstone Group have issued new bond series in Tel Aviv in recent months.

At the same time, observers expect investors to subject New York bond issuers to more scrutiny than in the past, with Brooklyn-based Satmar developers including All Year and Joel Gluck’s Spencer Equity in particular facing greater skepticism from bondholders.

Goldman has a 33.1 percent interest in the Spire Lofts rental project in Williamsburg, where Gluck owns a majority stake. An attempt to issue bonds secured by that project fell through in September amid questions about the property’s certificate of occupancy, which had been delayed for years because of overbuilt floor area.

All Year has remained active in New York despite its issues in Tel Aviv. The firm last month landed $55 million in financing from Downtown Capital Partners for its Gowanus project at 459 Smith Street and purchased eight other parcels in the Brooklyn neighborhood last year for $61 million.

Public records show that All Year closed on a refinancing of the second phase of the Rheingold Brewery redevelopment in June. It included a $170 million senior loan.

Goldman is also planning a mixed-use development spanning 244,000 square feet at 22 and 26 Clay Street in Greenpoint.