Trending

Deutsche Bank provided A&E $97M in financing for big Rego Park buy

The loan replaces prior financing from People's United Bank

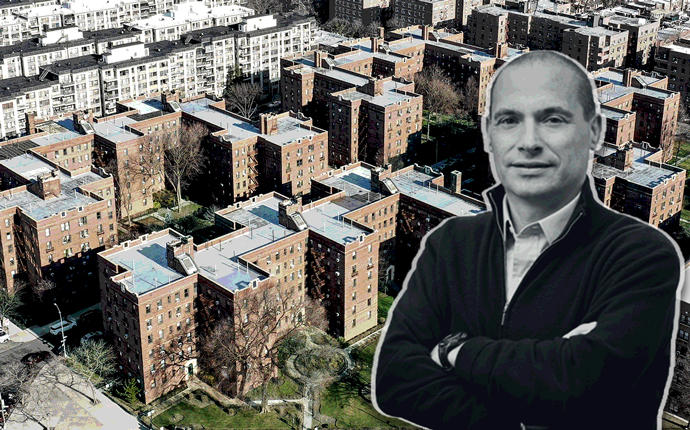

A&E Real Estate Holdings scored $97.5 million in refinancing from Deutsche Bank for its massive Rego Park portfolio, which was purchased together with development rights for $150 million.

The financing covers the real estate, purchased for $129.5 million, along with development rights and other business interests that the family owns, according to sources familiar with the transaction.

Deutsche Bank provided $97.5 million in financing, according to public records. The loan replaces prior financing from People’s United Bank, which provided $15 million in financing in 2013 and $18.5 million in financing in 2015.

A&E did not comment on the transaction. Deutsche Bank declined to comment on the transaction.

The refinancing is for a massive portfolio that A&E purchased from the Kestenbaum family in November at a steep discount from the listed price of $210 million. An initial offer for the portfolio was said to be made last year for $190 million, but was rejected by the seller.

While some observers speculated that the price chop was a sign of how far the multifamily market has fallen since legislators made drastic changes to the rent law in June, and that the bottom is yet to drop out, others have said the pricing was “reasonable and in line” with a healthy market.

The portfolio transaction dwarfs some smaller rent-stabilized buildings that have traded in recent months, after the city’s multifamily market ground to a halt after Albany severely limited increases in regulated rents and removed the ability to deregulate units.

The value of multifamily buildings sold in the third quarter of the year totaled $1.1 billion — roughly half of what it was in the same period last year.