Following a disastrous earnings report and a brief market panic, Yoel Goldman’s All Year Management might take drastic measures to calm down Israeli bondholders.

The Brooklyn developer plans to call bondholder meetings in the coming days to request their approval for the early payment of its Series C and E bonds, the company announced Monday. The bond series are secured by two of All Year’s most high-profile Brooklyn projects — one or both of which may need to be sold to pay back investors.

“The company is examining the possibility of a sale of one or more of the properties known as the William Vale Complex and Denizen Bushwick, and/or the refinancing of the loans established in favor of the mortgaged properties,” All Year’s disclosure states.

Representatives for All Year did not respond to a request for comment.

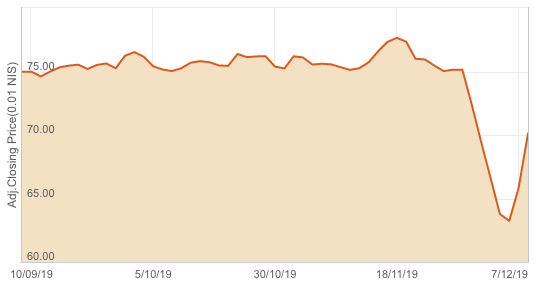

Israeli bondholders appear to have welcomed the news, as the prices of all four of All Year’s bond series have started to rebound from a week-long slide. The company’s unsecured Series D bonds, which fell the most over the past week, are now trading above 70 cents on the dollar after dipping to 63 cents last week.

In 2017, All Year’s Series C bonds made Tel Aviv Stock Exchange history by being the first U.S.-issued bonds to be secured by a single asset, the William Vale at 55 Wythe Avenue. While the majority of Tel Aviv bonds are unsecured, issuers sometimes offer secured bonds to boost investor confidence, and Goldman’s firm was able to raise $166 million with an uncommonly low interest rate of 3.95 percent.

Building on this success, Goldman made a similar play a year later by securing his Series E bonds with phase one of the massive Rheingold Brewery development. The developer raised more than $200 million for the site at 54 Noll Street and replaced a prior $215 million construction loan from Madison Realty Capital.

Later in 2018, however, All Year’s effort to refinance phase two of the Rheingold project was complicated by the market-wide panic in Tel Aviv, partially triggered by the developer’s own worrisome disclosures. After a saga that involved at least one aborted senior-loan deal and a pricey mezzanine loan, Goldman eventually landed $235 million in long-term financing from JPMorgan and Mack Real Estate Group for the the 468-unit rental at 123 Melrose Street.

All Year’s latest earnings report values the William Vale Complex at $250 million, and the Series C bonds were set to mature in Feb. 2024. Denizen Bushwick — phase one of the Rheingold development — is valued at $315 million, and the Series E bonds secured by that property were set to mature in July 2024.