WeWork insiders slam Neumann and his enablers: “They created the monster”

WeWork insiders slam Neumann and his enablers: “They created the monster”

Trending

Meet the financial backers behind WeWork’s rise and fall

A board of veteran execs and bankers enabled Neumann’s controversial decisions despite mounting problems

It was only after WeWork pulled its IPO and Adam Neumann’s ouster that one of the company’s board members took a stance.

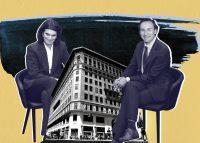

Former Goldman Sachs partner Mark Schwartz (Credit: Goldman Sachs)

In early October, former Goldman Sachs partner Mark Schwartz told WeWork’s board members: No more fantasizing — it was time to save the company.

“I’ve stayed silent too long,” he said, according to a Wall Street Journal profile on the financial executives behind WeWork’s rise and fall.

A group of veteran financial executives from Wall Street and Silicon Valley enabled Neumann’s grandiose plans for his company, and rarely pushed back even after years of growing problems and missed projections. Bankers including JPMorgan Chase championed Neumann in the hopes of landing WeWork’s IPO assignment, and the firm’s board of directors approved decisions by him for years that contributed to WeWork’s near-collapse.

Read more

WeWork insiders slam Neumann and his enablers: “They created the monster”

WeWork insiders slam Neumann and his enablers: “They created the monster”

WeWork’s white elephant: Insiders rip Lord & Taylor building buy

WeWork’s white elephant: Insiders rip Lord & Taylor building buy

Adam Neumann is leaving, but it won’t be on WeWork’s jet plane

Adam Neumann is leaving, but it won’t be on WeWork’s jet plane

WeWork insiders previously told The Real Deal that in addition to the board, the co-working giant’s investors, and even new CEOs, are to blame for the company’s terrible turn.

One move that furrowed the brows of directors was WeWork’s many acquisitions, according to the Journal. Over the course of two years, the company spent $500 million buying tech-related companies. At one point Neumann mulled buying Cushman & Wakefield, which has a $4.2 billion capitalization. He also made an offer to buy salad chain Sweetgreen, recently valued at $1.6 billion.

But in the wake of WeWork’s disastrous and failed IPO rollout, investors have grown much more skeptical of the business model centered on the all-powerful founder promising disruption and demanding control. Neumann stepped down from his CEO role earlier this year, and is receiving a hefty payout for selling his shares back to SoftBank, which took over WeWork to prevent a bankruptcy. Neumann remains a board observer and received a $185 million consulting fee from SoftBank.

He got at least one other perk as well, according to the Journal: forgiveness of $1.75 million in debt that he owed WeWork for personal travel on a company jet. [WSJ] — Eddie Small