A SoftBank-owned investment firm. A family friend. A national lending platform. And the former Bank of Internet.

It seems like everyone is out to get Toby Moskovits these days.

The high-profile Brooklyn developer and her partner Michael Lichtenstein, principals of Heritage Equity Partners, are fighting off foreclosure at a Bushwick development site. Creditors are after them for more than $10 million in alleged personal debts. And one of their flagship projects, the Williamsburg Hotel, is in receivership.

No fewer than a dozen lawsuits have entangled Heritage in the past nine months, raising doubts about the future of the business.

Michael Lichtenstein of Heritage Equity Partners

“There is currently a race among creditors of Moskovits and Lichtenstein to enforce rights against them and their entities,” an attorney for Richmond Hill Investment Co. observed in a court filing last month.

Richmond Hill is seeking $4.5 million from each partner related to adjacent office and hotel developments at 215 Moore Street and 232 Seigel Street, also known as the Bushwick Generator.

Moskovits and Lichtenstein’s control of the Bushwick properties is in jeopardy. A new lender, Fortress Investment Group, last year acquired their mortgages and says both are in default.

Rendering of 215 Moore Street

Moskovits, who in 2018 fought off a Crown Heights foreclosure she called “predatory,” is now leveling similar accusations against Fortress. Her court filings claim its managing director wants to “rip out [her] jugular,” and that one of the lenders who sold the mortgages was motivated by a “personal vendetta” and the other by an improper “quid pro quo.”

It’s not just institutional lenders causing Moskovits problems. Brooklyn investor Shaul Kopelowitz, a longtime acquaintance of Moskovits’ father, is seeking a roughly $3.3 million judgment against the developers for not fully repaying his $6 million loan to help them keep the Crown Heights property.

As an Orthodox Jewish single mother of three, Moskovits stands out among New York City developers. She started her career in Israel’s tech venture capital scene, then pivoted to real estate during the Great Recession and emerged as one of Brooklyn’s most prominent builders.

Moskovits is known for ambitious projects in relatively untested neighborhoods: the 147-key Williamsburg Hotel, a 193-unit rental building in Crown Heights and 500,000-square-foot office complex 25 Kent — the first ground-up commercial development in Williamsburg in more than 40 years.

But if Heritage’s creditors have their way, Moskovits and Lichtenstein could lose control of their projects and, moreover, lenders’ trust — as Lichtenstein has acknowledged.

“Such judgments would severely damage Moskovits’ and my personal reputations as prominent and successful real estate developers,” Lichtenstein said in his affidavit in the Richmond Hill suit, “destroying our ability to obtain financing for future projects and other opportunities.”

In a lengthy statement to The Real Deal, Moskovits said the creditors she is fighting simply do not understand or appreciate how entrepreneurship works.

“During the past decade we have dealt with dozens of lenders and investors in the amount of more than $1 billion,” she said. “Some … are great contributors in helping to bring our vision to fruition — and others are predatory lenders who forget that ultimately without an entrepreneur taking risks and turning a vision into a reality, there would be no business for them.”

Read more

Bushwick buzz

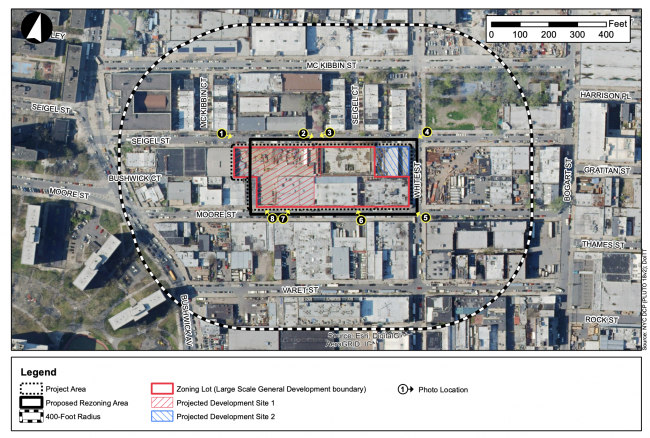

Moskovits and Lichtenstein picked up their 2.3-acre Bushwick site in late 2014, financing the $28.3 million acquisition with a $26 million loan from Richmond Hill Investment, property records show.

They planned to turn the Moore Street side of the site, occupied by five empty warehouses, into an office complex for tech and creative companies, and the vacant lot facing Seigel Street into a 144-key hotel.

But progress has been slow. An appraisal in May found the Moore Street property only 11 percent occupied, with tenants such as media company Remezcla and machine-learning platform Paperspace leasing office space in the warehouses.

Development at the site may have been impeded by the financing disputes that have recently come to light and the announced closure of the L train tunnel to Manhattan, which discouraged prospective tenants for months before being called off. Fortress notified Heritage two days after acquiring its loan last May that it was in default for missing payments and not finishing construction by the October 2018 deadline in the loan agreement.

Moskovits applied to rezone the site last August to allow for more square footage, and YIMBY published renderings of the 13-story project soon after. But in September, Fortress sued to foreclose on the site.

The site of 215 Moore Street (Click to enlarge)

“Creating distress”

Fortress, which Masayoshi Son’s SoftBank Group acquired for $3.3 billion in 2018, filed its suit on the 215 Moore Street parcels just four months after picking up the developers’ mortgage.

Heritage had been negotiating a refinancing with another lender when Axos Bank sold the mortgage. “They were getting ready to close the new financing and found out that Fortress had bought the loan,” a source told Commercial Observer. It is unclear why Heritage could not proceed with the refinancing after the sale.

The senior debt at 215 Moore Street played a role in a minor scandal in 2018, when it was revealed that President Donald Trump’s son-in-law and senior adviser Jared Kushner had overreported income on two Brooklyn loans, including $33 million lent to Moskovits in 2016 as part of Kushner Companies’ push into peer-to-peer lending.

Kushner’s loan was refinanced by California-based BofI Federal — which is now Axos and was formerly called Bank of Internet — in 2018, shortly after the bank had emerged unscathed from a Securities and Exchange Commission investigation.

Moskovitz blamed Fortress for her problems in Bushwick.

“Fortress Investment Group is a notorious predatory lender who has demonstrated again and again that when they find deals they want that are not distressed, they do their best to create the distress,” Moskovits said. “Fortress, and their owner SoftBank, will be exposed as the destroyer of entrepreneurship, and Fortress as a lender to be avoided at all costs.”

“Predators”

By the time Fortress came calling for the 215 Moore loan, Moskovits and Lichtenstein were in the middle of another foreclosure dispute.

Benefit Street Partners Realty Trust, the CMBS lender that had sought to foreclose on Heritage’s Crown Heights building — 564 St. John’s Place — a year earlier, moved to foreclose on the Williamsburg Hotel in June. A judge ordered the appointment of a receiver for the property in October and one was chosen in February after months of legal wrangling.

[Moskovits and Lichtenstein] employ here a trite strategy: assuring the court that the project is expertly managed and they are victims of rapacious lenders — Fortress Investment Group, in a legal filing

The other piece of the Bushwick Generator site, 232 Seigel, ran into problems as well. In November, Moskovits sued the lender on the hotel development site — BridgeCity Capital — to fend off default and acceleration notices on a $5.25 million mortgage.

BridgeCity then sold its loan to Fortress, and Moskovits refiled her suit in January, adding allegations against Fortress.

Throughout these disputes with lenders of various shapes and sizes, Moskovits has stuck with the same line: that they manufactured technical defaults in an effort to illegitimately seize control of her properties.

Under a position of extreme duress, Moskovits and I chose to save our business, as any owner would — Michael Lichtenstein, in an affidavit

“Fortress’s managing director, Spencer Garfield, has boasted that Fortress will ‘rip out [the] jugular’ of [Heritage’s] principal and well-known real estate developer, Toby Moskovits,” Heritage’s January complaint against Fortress and BridgeCity states. It goes on to allege that BridgeCity’s “bad faith conduct” was fueled by its principal Allan Lebovits’ “personal vendetta” against her.

According to her lawsuit, Moskovits had found a buyer for the Seigel Street property to pay off the debt, but BridgeCity told the prospective purchaser to instead wait and buy it for a lower price from the lender.

Moskovits also alleged in a January affidavit that Fortress promised a job to an Axos loan officer if he helped Fortress succeed in its foreclosure “scheme,” and that Axos requested modifications to the loans “to help stave off federal regulators.”

Fortress’s lawyers reject these claims and point to other foreclosure suits against Moskovits as proof of her financial problems. Moskovits and Lichtenstein “employ here a trite strategy: assuring the court that the project is expertly managed and they are victims of rapacious lenders,” a January memorandum states.

“But in similar recent and pending lawsuits, their real estate projects are failing and, in response, they have lodged identical defenses as here to try to delay the enforcement of the lenders’ rights,” it continues, adding that Heritage has failed to meet construction, payment, and other obligations on similar projects.

Representatives for Fortress did not respond to requests for comment. BridgeCity declined to comment.

A spokesperson for Axos denied Moskovits’ allegations against it, saying, “We are confident in the propriety of our actions and the processes we followed.”

Developers under duress

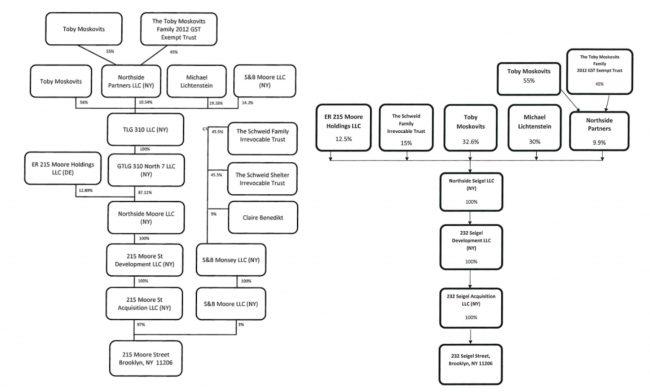

The loans on the Bushwick Generator properties have now changed hands several times over the years, but the original acquisition lender, Richmond Hill Investment, still has unfinished business with Heritage Equity Partners.

In January the firm sued Moskovits and Lichtenstein as individuals, seeking $4.5 million plus interest and costs from each. A week later, the partners shot back with a lawsuit accusing Richmond of a breach of fiduciary duty.

Although the partners signed papers acknowledging what they owed, their suit attributed that to economic duress and the lenders’ “bad faith” and “blatant fiduciary violations,” and asked that the documents be thrown out. It notes that Richmond Hill had acquired equity stakes in the properties following loan modifications, and alleges that the lender took advantage of its position to block third-party refinancing and force onerous terms on the borrowers.

Lichtenstein said in an affidavit that by announcing a foreclosure sale while the partners sought new financing, Richmond Hill “succeeded on their nefarious plan to stymie the LLC’s efforts to pay off defendants’ loan.”

“Under a position of extreme duress, Moskovits and I chose to save our business, as any owner would,” the affidavit continued.

The complex ownership structure of the Bushwick Generator properties. ER 215 Moore Holdings LLC is controlled by Richmond Hill Investment. Source: New York State Unified Court System (Click to enlarge)

Richmond Hill sees things differently. “Never during these discussions … did Moskovits or Lichtenstein suggest that their confessions of judgment had been ‘coerced’,” managing partner Ryan Taylor said in an affidavit, adding that Moskovits or Lichtenstein were the ones who proposed signing affirmations of what they owed.

Taylor also said the partners offered an equity stake in the Williamsburg Hotel in exchange for an extension of the loan on 232 Seigel, but were unable to obtain the mortgage lender’s consent for such a deal.

A representative for Richmond Hill declined to comment.

“There was no loan”

Faced with mounting difficulties from institutional lenders, Moskovits turned to a fellow member of the Orthodox Jewish community for money. But that deal has soured as well.

In December, Shaul Kopelowitz sued Moskovits and Lichtenstein over a $6 million loan he provided in 2018 to help cover financial obligations at 564 St. John’s Place, which he said was only partially repaid after the property was sold for $117 million in July.

“As I had a longtime relationship with Moskovits’s father and have known her since she was a child, I not only agreed to help her by lending the LLC the sum of $6,000,000.00, but I gave her a favorable interest rate of 5%,” Kopelowitz said in an affidavit.

According to the document, the specifics of the $6 million loan were complicated by Moskovits’ existing debt load and the biblical injunction against charging interest within one’s tribe, which led the parties to structure it as a preferred equity deal. Moskovits, in her response, argued that Kopelowitz only made an equity investment and that “there was no loan.”

Kopelowitz filed a second lawsuit in January, demanding that Moskovits and Lichtenstein use their interest stakes in various LLCs to pay off their remaining debt if necessary.

In late January, a judge denied Moskovits’ motion to vacate a confession of judgment she and Lichtenstein signed.

“Regardless of whether the original investment can be characterized as an investment or a loan there can be no dispute the confession of judgment clearly concerned a loan,” the decision states. It did not determine the exact amount owed.

A representative for Kopelowitz did not respond to requests for comment.

In February, the developers upped the ante by suing Kopelowitz’s lawyer, Neil Fink, who they claim wrongfully delivered a confession of judgment signed by both partners to Kopelowitz “in wanton disregard” of their rights. For this, Moskovits and Lichtenstein are seeking a $70 million judgment plus $90 million in damages.

“Neil Fink violated his fiduciary obligation as attorney and escrow agent in a misplaced loyalty to Shaul Kopelowitz, who is attempting a shakedown,” Moskovits said in a statement. “The documents they are using are invalid, and they have co-conspired in a flawed attempt to extort us. Unfortunately Neil Fink is collateral damage in this matter and we will hold them both liable for their actions to the fullest extent of the law.”

Show up to @BushXGenerator. Influence it if you can. Make it yours if you dare.

— Bushwick Generator (@BushXGenerator) February 24, 2019

Ahead of its time

Despite the deluge of legal battles — which also includes suits from a law firm, a construction-safety firm and a concrete subcontractor over unpaid fees — Moskovits still projects confidence in her Bushwick development.

“In spite of Fortress’ predatory tactics we will be replacing these loans and continue the development of the 215 Moore project, expanding our transformational work in the tech industry and in the neighborhood of Bushwick,” Moskovits said.

The developer’s collaborators seem to share this optimism.

Kith Founder Ronnie Fieg, and 25 Kent Avenue (Credit: Getty Images and Kith)

“Real estate is in the middle of epic change, and six years ago Toby Moskovits and Michael Lichtenstein foresaw these changes, when briefing me on their vision of 25 Kent,” Matthias Hollwich, principal of Manhattan architectural firm Hollwich Kushner, said in a statement. He predicted that 215 Moore “will again be five years ahead of its time.”

The original “Generator” project, 25 Kent secured its first office tenant in December, months after construction was completed, when fashion brand Kith signed a lease for almost 58,000 square feet.

Moskovits also had a hand in the development of the William Vale complex and the Spire Lofts apartments in Williamsburg, but she gave up her stakes in those projects after falling out with former partners Yoel Goldman and Joel Gluck.

“In many of these properties, I’m in much cheaper than other people were able to buy at, simply because I moved sooner and took risks that the typical real estate industry learned to reject,” Moskovits told TRD in 2015.

It remains to be seen if those risks will pay off.

Write to Kevin Sun at ks@therealdeal.com and Eddie Small at es@therealdeal.com